As the CBD industry continues to grow, more and more of the canna-curious are getting drawn into the market and trying products for themselves. With more consumers, we can see how diverse CBD consumers actually are; in this article, we explore how the most frequent users of CBD compare to occasional users.

There are three Brightfield personas who constitute most daily users – Daily Symptom Attackers, Glam Users, and Grassheads.

- Daily Symptom Attackers are individuals who suffer from chronic conditions and use CBD in order to manage their pain

- Glam Users tend to be high-income and well-education women who primarily purchase edibles

- Grassheads are daily cannabis users who also like to indulge in CBD products. All other consumer segments tend to consume with a lower level of regularity

Heavy users of CBD (5+ days/week) account for 25% of consumers but about 75% of the market in monetary terms. If a brand can understand who its heaviest customers are, it can position itself for success. Glam Users and Grassheads may both enjoy a CBD preroll, but a sungrown hemp and lavender spliff will sell very differently than a dollar sign printed, gold-tipped joint.

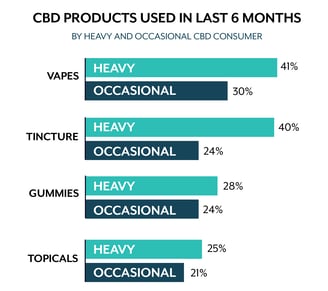

Heavy CBD users use tinctures more often than infrequent users. According to our 2019 consumer survey, for heavy users, tinctures ranks a close second in overall popularity – with 39.7% having purchased recently. For comparison, 24% of occasional CBD consumers (using a few times per month) had recently purchased a CBD tincture. When consuming on a daily basis, CBD becomes part of everyday ritual. Knowing what products fit into which consumers lives allows brands to find where they fit in these habits.

Heavy CBD users use tinctures more often than infrequent users. According to our 2019 consumer survey, for heavy users, tinctures ranks a close second in overall popularity – with 39.7% having purchased recently. For comparison, 24% of occasional CBD consumers (using a few times per month) had recently purchased a CBD tincture. When consuming on a daily basis, CBD becomes part of everyday ritual. Knowing what products fit into which consumers lives allows brands to find where they fit in these habits.

While, regardless of usage, all consumers likely heard about CBD from a friend or family member, the more people use the more likely that they are to have been introduced to CBD products by a doctor. For instance, 20.6% of those who consume CBD near daily were informed of its effects be a medical professional. On the other hand, only 10.7% of occasional users heard about CBD products from a doctor. This is just one step in a consumers path to purchase, but brands that understand how their customers came to be heavy CBD users more effectively foster loyalty with those new to CBD.

In addition to measuring how, why, and what heavy CBD consumers purchase, our consumer insights also measure aspects of users’ personalities. While all CBD users tend to be introverted, those who use the most frequently are significantly less introverted. In addition, users who consume CBD multiple times a week are prone to positive patterns of thinking while those who use CBD occasionally are more negative in their approach to life. Similarly, frequent users tend to be more joyful in their psychology while less frequent users are less happy and are generally angrier. Brands should be exploring the positive reactions consumers’ have to their products or similar products to deeply understand where they fit in their lives and how to turn an occasional user into a frequent and loyal one.

Last Updated: 4/9/20