Recently, the fitness and wellness landscape has witnessed a paradigm shift from a sole focus on weight loss to an increased emphasis on strength and muscle building. Brightfield Group's latest insights reveal significant trends in consumer behavior, particularly in the realm of protein consumption and muscle-building supplements.

The Rise of High-Protein Diets

Our data indicates that about one-third of consumers actively seek high-protein products, signaling a robust market demand. This trend, fueled by a desire for muscle building and strength, is gaining momentum. Social media platforms like Pinterest and TikTok have seen a significant uptick in content related to high-protein diets. From creative meal-planning ideas to visual representations of protein-rich foods, these platforms are buzzing with discussions and tips on integrating more protein into daily diets.

On social media, Americans share goals of consuming at least 30 grams of protein per meal. This practice, aimed at achieving a daily intake of 90 to 100 grams, is recommended to maintain a healthy muscle-to-fat ratio. Pinterest is full of recipes to help people reach those 30gs of protein.

Women Leading the Protein Trend

Contrary to past trends where protein consumption was more associated with men, recent data shows a notable shift with women increasingly focusing on protein. Products like protein bars, hummus, tofu, and both dairy and plant-based protein powders are seeing significant year-over-year growth in popularity among female consumers. Gen X women, in particular, are over-indexing in their preference for products with high protein claims, reflecting a broader trend of women prioritizing strength and muscle health.

.png?width=600&height=400&name=In-Blog%20Asset%20(26).png)

The evolution in women's fitness regimes is also contributing to this trend. There's a noticeable shift from purely cardio-focused exercises to incorporating strength training and muscle-building activities. This change in fitness approach necessitates a corresponding shift in diet, where protein plays a vital role in muscle recovery and growth. From Q1 to Q3 2023, women reporting weight lifting/strength training as a top three exercise increased from 18% to 20%.

For businesses in the wellness industry, this trend presents an opportunity to innovate and cater to the specific protein needs of women. Developing products that not only meet the nutritional requirements but also address the taste preferences, lifestyle needs, and health goals of women will be key. Additionally, marketing strategies should evolve to acknowledge and celebrate the diverse reasons women choose high-protein diets, from athletic performance to overall health and wellness.

Beyond product development, there is a significant opportunity for educational outreach. Helping women understand the role of protein in their diet and how it supports their fitness and health goals can foster a more informed consumer base. Community-building efforts, such as online forums, social media groups, and fitness events, can also support women on their wellness journeys.

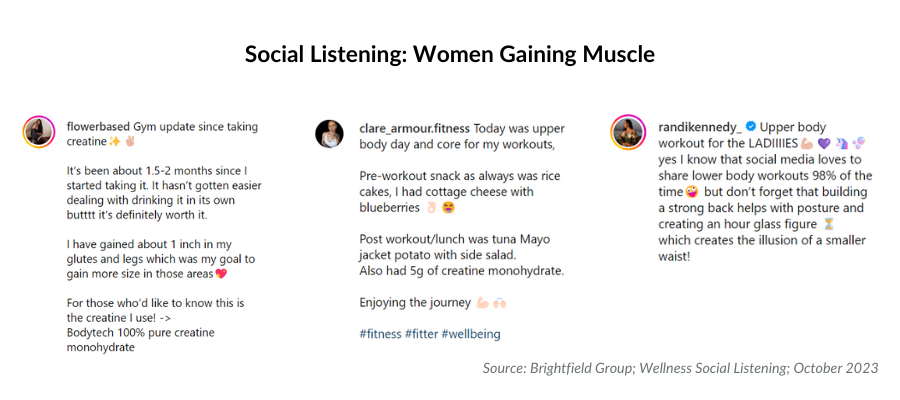

Creatine: Gaining Popularity Among Men

Creatine, traditionally popular in the bodybuilding and athletic communities, has recently seen a broader surge in popularity. This amino acid, which is naturally found in small amounts in the human body, has become a key focus for those seeking enhanced muscle mass and improved athletic performance.

Creatine is known for its ability to quickly replenish energy during high-intensity, short-duration exercises, like sprinting or weight lifting. This makes it particularly appealing to athletes and fitness enthusiasts who are looking to improve their strength, power, and overall performance.

Young men are especially drawn to creatine. Brightfield Wellness Consumer Insights shows they’re purchasing more in Q3 2023 than at the start of the year, and the influx in social posts evidences their use.

The role of social media platforms, particularly TikTok, in popularizing creatine cannot be overstated. Content creators are sharing their experiences with creatine supplements, showcasing the tangible benefits in muscle building and athletic performance. This has led to a significant increase in creatine's visibility and appeal, especially among younger demographics like Gen Z and Millennials.

.png?width=600&height=400&name=In-Blog%20Asset%20(27).png)

Supplement Form Factor: Gummies

Creatine gummies have been a specific point of interest on social media, with brands like SWOLY and Beast Bites catering to muscle-seeking audiences. In general, gummy supplements are a wider trend, with Americans in 2023 being 14% more likely to use gummy vitamins than in 2021.

Creatine gummies came on the scene, with internet brands like Beast Bites and SWOLY bringing the convenience of gummies to creatine users. The protein gummy trend is very new. Only a few brands exist, like Ultimate Paleo Protein Gummies, LiquaCel Protein Gummies, and Vital Proteins Collagen Gummies. Traditionally, protein has been in drinks and snacks. Current brands in the gummy supplement space should consider how they could hop on this growing, new desire for gummy protein.

Market Implications and Future Trends

The growing consumer interest in muscle-building and high-protein diets offers significant opportunities for the wellness industry. As "strong is the new skinny" continues to gain traction, businesses can innovate by introducing protein-rich products and supplements like creatine that cater to this evolving market demand. It's essential for companies to stay attuned to these trends, as indicated by social listening and consumer insights, to develop products that resonate with the shifting preferences of both male and female consumers.

With no peak in sight for the popularity of protein-focused diets and muscle-building supplements, businesses should consider incorporating these elements into their product development and marketing strategies. Staying ahead of these trends will be crucial for companies looking to make an impact in the rapidly evolving wellness and fitness landscape.

Published: 01/24/2024