Weight loss is consistently on the minds of Americans. Brightfield Group’s Wellness Consumer Insights and Social Listening can dive deep into the pain point of weight loss to understand how its evolving over time. The weight loss trends of 2022 are no longer relevant in 2024. With updated data that reveals the consumer today, let’s explore the current game changers in weight loss and future trends to get ahead of.

The State of Weight Loss in the US

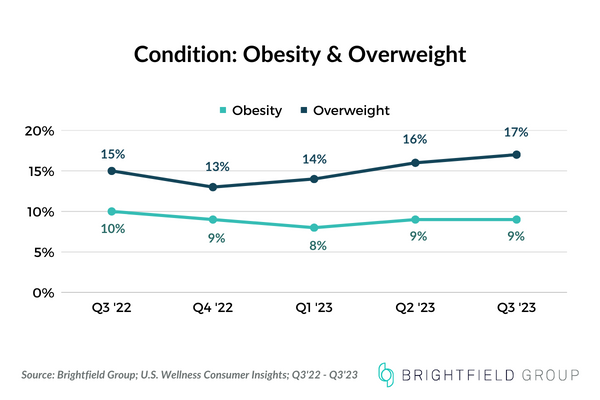

Despite stable obesity rates since 2003, the US continues to have one of the highest levels of obesity among high-income countries. According to the American Medical Association, about 36% of Americans are obese, and 69% are either obese or overweight. However, our survey reveals a significant underreporting of weight conditions, possibly due to a lack of awareness or the stigma associated with obesity.

Our data shows that while half of Americans are actively trying to lose weight, many are reluctant to label themselves as overweight or obese. This highlights a psychological barrier in acknowledging weight issues, despite a conscious effort to address them.

Popular Weight Loss Supplements

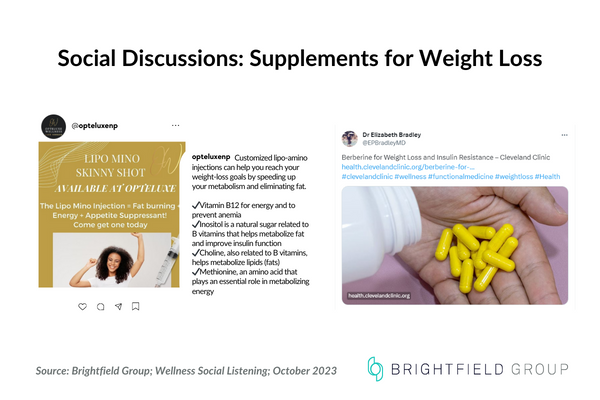

Americans continue to use common weight loss supplements like apple cider vinegar and green tea extract. These traditional supplements, known for their metabolic-enhancing and appetite-suppressing properties, remain staples in many weight management regimens. Wellness Social Listening shows how conversations around these supplements have grown.

However, new supplements are gaining traction. These include:

Anastatol: A sugar alcohol beneficial for managing insulin levels and metabolic conditions.

Berberine: Known for promoting weight loss and regulating blood sugar.

The Ozempic Phenomenon

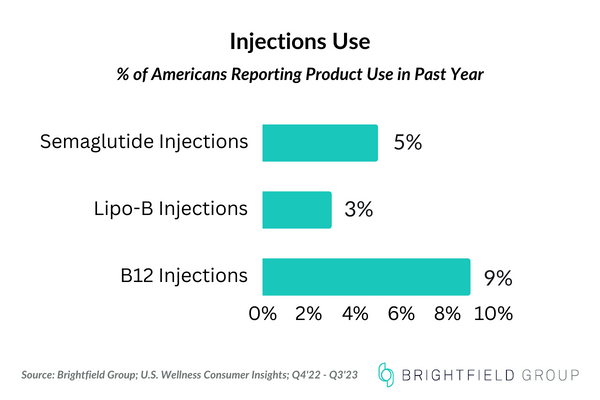

The Ozempic craze has taken the market by storm, highlighting a significant shift in weight loss approaches. Our data shows that about 5% of survey respondents use weight loss injections, with a demographic skew towards males and those in the millennial and Gen X age groups. Interestingly, a substantial portion of these users are city dwellers with higher incomes and are actively engaged in exercise and diet management.

Ozempic, the brand name for semaglutide (pronounced Se-ma-glu-tide), led the way in this trend. Following its footsteps, other semaglutide-based medications such as Wegovy, Mounjaro, and the newly introduced Zepbound have emerged. These drugs, prescribed for diabetes or obesity, aid in weight loss by suppressing appetite and curbing food cravings. Additionally, non-branded, compounded alternatives are available at medspas without a prescription, though the FDA has issued warnings about these.

With dozens of celebrities like Orpah Winfrey, Elon Musk, and Khloé Kardashian speaking up about their use of Ozempic, the popularity of these medications is so pronounced that some analysts believe they are influencing broader market trends. The recent decline in the S&P beverage index has even been attributed to the reduced food intake of Americans using these drugs for weight loss.

Future Weight Loss Trends: Fiber and Diet Innovations

Looking forward, there is growing interest in natural alternatives to weight loss drugs. Research into fermentable fibers like oats, barley, and legumes shows promise in mimicking the effects of medications like Ozempic.

Health Benefits of Fiber

Fiber's role in the diet extends far beyond just aiding digestion. It is recognized for promoting feelings of fullness and as a natural mechanism to reduce overall calorie intake. Fiber’s role in regulating blood sugar levels makes it essential for those focused on weight loss, providing a stable energy release and curbing sudden hunger pangs. Additionally, fiber's support of a healthy gut microbiome is gaining recognition for its broader impact on overall health and weight control. A well-functioning gut directly influences nutrient absorption and metabolism, further underscoring the importance of fiber in a balanced diet.

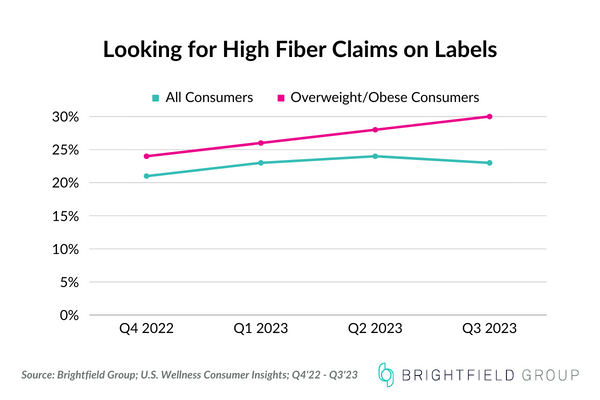

Consumer Awareness and Demand

The benefits of fiber are increasingly acknowledged by consumers, particularly in the context of weight loss and overall health. This growing awareness is driving consumer demand for products rich in fiber. Consequently, the market is witnessing a surge in high-fiber products, ranging from dietary supplements to fortified foods and beverages. These products align with health-conscious consumer demands and are reshaping the landscape of functional foods as they cater to the dual goals of weight management and nutritional wellness.

Natural Alternatives to Medications

The desire for “natural Ozempic” and returning to the basics of good nutrition shows a shift towards natural dietary alternatives to conventional medications. Scientists are actively researching diets that can mimic the effects of popular weight loss drugs. This research predominantly focuses on targeting the body's appetite and metabolism-regulating hormones.

Among the ingredients gaining momentum are fermentable fibers found in foods such as oats, barley, artichokes, and legumes. These fibers are notable for their potential to increase satiety-inducing hormones like GLP-1, offering a natural pathway to appetite control and weight management.

Holistic Dietary Approaches

The approach to dieting is undergoing a transformation, moving beyond mere calorie counting. There's a growing inclination towards holistic dietary patterns that prioritize overall wellness alongside weight loss. This holistic approach includes mindful eating practices, which encourage a more attentive and conscious relationship with food. Mindful eating is not just about what is consumed but also how and why, fostering a healthier and more sustainable approach to eating and weight management. This shift reflects a deeper understanding of diet's role in overall well-being.

The insights from Brightfield Group's Wellness Consumer Insights and Social Listening provide a critical understanding of the current and future trends in weight loss. Businesses in the wellness sector can leverage these insights to align their strategies with these emerging patterns and cater to evolving consumer needs.

Published: 01/17/2024

.png?width=600&height=150&name=Blog%20CTA%20(16).png)