Brightfield Group has been at the forefront of market research in the cannabis industry since 2015, watching the dynamic Canadian recreational market emerge since 2018. Today, we see an industry navigating through a phase of economic challenges, regulatory revocations, and shifting consumer needs.

Our comprehensive analysis of the 2023 landscape draws upon our extensive consumer, brand health, market, and distribution data that offers businesses a clear understanding of the current state of the market. From the evolving product preferences to the growing normalization of cannabis in everyday life, Brightfield Group data provides insights that are critical for anyone looking to navigate this complex and ever-changing industry.

Knowing the key trends defining the Canadian cannabis landscape in 2023 will allow businesses to make informed, data-driven decisions to stay ahead in this vibrant market in 2024.

- The State of the Canadian Cannabis Market

Growth Trajectory: The Canadian cannabis market is expected to reach $7.2 billion in 2027, driven by significant demand in provinces like Ontario and Alberta. Ontario, in particular, shows promise with a high compound annual growth rate of over 20%.

Product Preferences: Flower and pre-rolls remain the most popular products among Canadian cannabis consumers. Innovations in this segment, like infused pre-rolls and pre-milled flower, are gaining traction. Cannabis drinks also emerge as a growing trend, enjoying more popularity in Canada compared to the U.S.

Consumer Behavior: The normalization of cannabis use in Canada is evident, especially post-pandemic. Usage occasions are expanding to include everyday meals and social gatherings like dinner parties, indicating cannabis's increasing integration into daily life.

- Provincial Comparisons

There are significant variances in cannabis usage across Alberta, British Columbia, and Ontario. Despite federal legalization, each province exhibits unique cultural and demographic characteristics influencing consumer habits:

Alberta and British Columbia show similar rates of heavy usage, but Alberta also has a higher proportion of infrequent users. Ontario lags slightly in heavy usage but leads in certain product preferences like cannabis drinks and baked goods. These findings underscore the necessity for tailored marketing strategies that resonate with the specific demographics and preferences of each province.

- Milled vs. Whole Flower Users

The rise of milled flower in the Canadian market highlights a shift in consumer preferences. Younger demographics, especially Gen Z and Millennials, are more inclined towards milled flower, whereas older generations prefer whole buds. This trend reflects a broader shift in the cannabis market, emphasizing the need for product innovation and diversity.

- Demographic Shifts

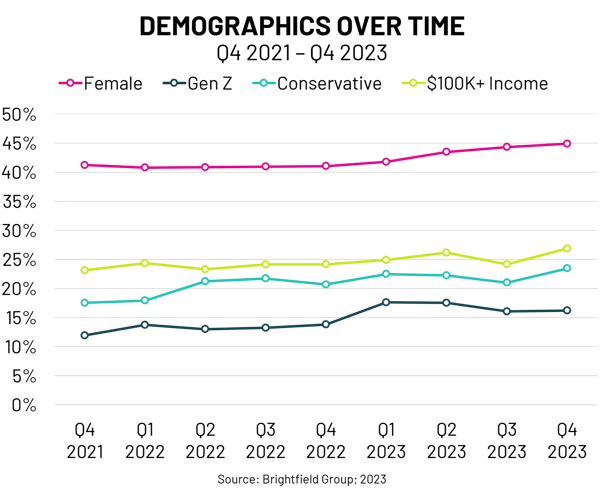

The Canadian cannabis consumer profile has undergone significant changes in gender, age, and political affiliations:

Gender Dynamics: There's been a steady increase in female cannabis users, indicating a narrowing gender gap in consumption.

Age Groups: A notable rise in Gen Z users points to the entry of younger consumers into the market.

Political Affiliations: A shift in political alignment among consumers suggests growing acceptance of cannabis across the political spectrum.

These shifts highlight the evolving societal acceptance of cannabis and the importance of staying attuned to these changes for effective market positioning.

- Desired Effects and Gender Differences

Desired Effects: Relaxation remains the primary desired effect, followed by fun/celebration and sleep. This diversity in desired outcomes shows the multifaceted use of cannabis among consumers.

Gender Differences: Women are more likely to be newer consumers and use cannabis for different medical conditions compared to men. This gender-specific data is crucial for companies aiming to address the unique needs of each demographic.

Purchasing Decision Drivers: Consumers prioritize THC/CBD content and price over other factors, revealing a focus on value for money and desired effects. Brand recognition, while important, ranks lower, suggesting that consumers are more driven by product quality and cost-effectiveness.

- Understanding Consumer Groups in Canadian Cannabis

Brightfield Group’s Canadian Consumer Insights spots distinct segments of the population to make it easy for brands to target specific consumers. Trends we see include:

Legacy Loyalists: Representing a smaller, predominantly male segment, these consumers prefer specific product categories like edibles and concentrates.

Tranquil Tokers: A larger, more gender-balanced group, these consumers favor a wider range of products, including mints/lozenges and disposable vapes.

Reaching these segments can require different strategies. For instance, over one third of Tranquil Tokers rely on budtenders to learn about new products and brands. In 2023, 83% of budtenders disclosed using cannabis daily, suggesting that products tailored for frequent users could receive stronger recommendations from store personnel. Brightfield will soon be launching its 2024 Canadian Budtender study to provide further insight into how retail associates drive sales for all sorts of consumer groups.

Conclusion

The Canadian cannabis market presents a dynamic and diverse landscape. For cannabis companies, leveraging these insights can lead to more effective strategies that resonate with various consumer segments. Staying ahead of these trends will be key to navigating the complex and ever-changing world of cannabis consumption in Canada.

Published: 01/10/2024