The U.S. cannabis market is in an interesting spot as price compression hits some markets while the tide of expansion via legalization continues onward. Brightfield Group provides a realistic view of where cannabis sales are headed with our multi-sourced approach to determining the cannabis market size. Our cannabis market research utilizes state-reported data, point-of-sale reporting, consumer surveys, industry developments, regulatory news, and expert industry analyses.

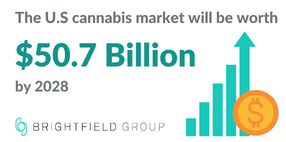

What is the U.S. cannabis market worth? In 2022, the U.S. cannabis market reached $27 billion in sales. By 2028, it is forecast to be worth $50.7 billion! Let’s look at the trends that brought us here today and will guide growth in the cannabis market in the future.

What is the U.S. cannabis market worth? In 2022, the U.S. cannabis market reached $27 billion in sales. By 2028, it is forecast to be worth $50.7 billion! Let’s look at the trends that brought us here today and will guide growth in the cannabis market in the future.

2022 Was a Tough Year

2022 was the first slow growth year the U.S. cannabis industry has seen. Following the 30% jump in annual sales from 2020 to 2021, the 1% increase from 2021 to 2022 was certainly a jarring departure. The change can largely be attributed to a decline in sales in several mature cannabis markets, such as Colorado, California, and Oregon.

How will growth in West coast cannabis rebound from 2022?

Download the US Cannabis Market Forecast Infographic to see the data

What caused the change? As 2022 progressed, it became clear how much the COVID-19 pandemic and associated relief measures boosted cannabis sales. Stimulus checks and increased unemployment benefits meant many had money to spend. Plus, stay-at-home orders and a shift towards remote working provided ample opportunities for cannabis consumption.

While these boons wore off and the country started to experience increased inflation and interest rates, consumers became more frugal, reporting spending less on cannabis on monthly and per product. In mature markets where supply had risen to meet increased pandemic demand, wholesale prices began to crash, creating a more difficult environment for long-standing local businesses and multi-state operators (MSOs) alike.

But Not Tough Everywhere

Despite some mature markets seeing sales drop in 2022, others continued to maintain their patterns of strong growth – highlights that bode well for the industry's future. One example is Massachusetts, a state that began adult-use sales in November 2018.

By the end of 2022, its fourth year in operation, Massachusetts surpassed $250 in annual adult-use cannabis spending per adult resident, stronger per capita sales than either California or Washington, and grew 16% year-over-year. While this has been accompanied by a sizable drop in retail prices that has made the state’s competitive environment more difficult, this development is helping legal sales increasingly displace the legacy market.

Michigan is another example. The state’s adult-use market experienced unusually strong growth following a slow first year, with year-over-year sales increasing by nearly 172% through its second year and by 49% from its second through third. Maine, a market that opened in 2020, has also seen a rapid increase in growth, increasing by 133% from its first to second year.

Seven New Markets Opened (Plus Three in 2023 So Far)

2022 was a big year for cannabis market openings, with seven states opening cannabis markets over the course of the year. 2023 is off to a strong start as well, with three more beginning sales within the first two months of the new year.

How big will Missouri, Connecticut, and Mississippi’s cannabis markets be?

Download the US Cannabis Market Forecast Infographic to see the data

Many of these market openings were in the East, the first region of the U.S. that is expected to have all states legalize adult-use. Between April 2022 and January 2023, five states in the region commenced adult-use sales – New Jersey, Vermont, Rhode Island, New York, and Connecticut.

Two Western states also began adult-use sales in 2022, namely Montana and New Mexico, while the Midwestern South Dakota began medical sales by mid-year. Along with Connecticut, the two states that have begun sales in 2023 so far are Mississippi (medical) and Missouri (adult-use).

Some New Market Openings Were Massive!

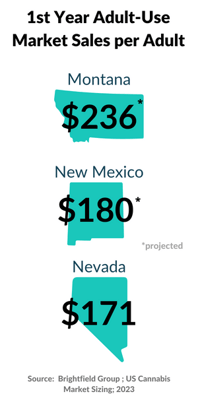

Two of these states stand out as having particularly strong market openings – Montana and New Mexico. A typical adult-use market has sales of $55-70 per adult during its first year of operations, though some states have performed significantly better. Prior to 2022, the strongest opening was Nevada, with $171 in sales per adult.

Two of these states stand out as having particularly strong market openings – Montana and New Mexico. A typical adult-use market has sales of $55-70 per adult during its first year of operations, though some states have performed significantly better. Prior to 2022, the strongest opening was Nevada, with $171 in sales per adult.

Montana has usurped the total. By the end of 2022, the conclusion of the market’s first year, adult-use sales in Montana totaled $236 per adult. Though its first full year has yet to conclude, New Mexico is also expected to surpass Nevada, with a per-adult forecast of more than $180. The key characteristic that these markets share is the presence of a robust medical retail and cultivation infrastructure prior to the implementation of adult-use sales that could be effectively turned dual-purpose without significant supply hiccups.

More New Cannabis Markets are on the Way

The story of cannabis legalization is far from over – many more market openings are expected over the next few years. Maryland is likely to be the first to kick things off, following a successful ballot initiative last November. The state is expected to begin sales in mid-2023, making it the first Southern state to begin adult-use sales.

Other markets in the South are worth watching as well. Oklahoma will have a ballot initiative dedicated to adult-use legalization in March 2023 and Virginia legislators are continuing to debate the details of cannabis regulation following legalized possession starting in 2021. With other expected adult-use markets like Pennsylvania on the horizon, as well as medical legalization in states like North Carolina and Wisconsin, U.S. cannabis is expected to see significant growth from markets yet to start sales.

Federal Government Disappoints

Despite lofty hopes from the industry and pledges from lawmakers, 2022 saw little in the way of concrete cannabis action at the federal level. Congress passed and signed a research bill, the Medical Marijuana and Cannabidiol Research Expansion Act, and the Biden administration announced that it would be reviewing the scheduling of cannabis alongside the Drug Enforcement Agency (DEA), but market-moving actions were lacking. The SAFE Banking Act, one of the “easier” pieces of legislation to pass, saw little movement and legalization efforts lost momentum in the Senate.

A Republican House is unlikely to let anything pass before the next election cycle, either. GOP Speakers typically adhere to the “Hastert Rule,” only allowing a floor vote for legislation approved by the majority of the Republican Caucus, a metric that cannabis bills will likely fail despite sizable bipartisan support. While the cannabis industry looks to November 2024, it is worth reflecting on some of these bills and what ideal federal regulation would look like. Many of the tax provisions included in legalization bills would have hindered industry growth as much as they might have helped.

Published: 2/21/2023