Understanding Consumers in Diverse Cannabis Landscapes

The way a state legalizes cannabis will greatly influence how consumers interact with the market - from how dispensaries can display products to the number of operators able to grow and brand cannabis. Brightfield Group’s new US Cannabis Retail Brand Health study is the first to explore how consumers perceive their dispensary experience based on the market they shop in and the retailers they frequent. The study looked at eleven state cannabis markets, including medical-only markets, emerging limited-license markets, and some of the most mature markets in the nation. This shows us a rich, diverse picture of the cannabis landscape as it actually stands, segmented and separated by state lines.

The differences between cannabis retail landscapes are evident when exploring two contrasting adult-use markets: Michigan and Illinois. These Midwest states legalized adult-use cannabis a month apart but are about as different as two markets can be. Let’s explore how these two markets’ retail landscapes are shaping up nearly three years after legalization.

Setting Up the Retail Landscape

Michigan

Michigan took a patient-centered approach to cannabis when it became the first Midwest state to legalize medical cannabis in 2008. Patients were allowed to cultivate 12 cannabis plants, but no formal medical dispensaries were licensed. Ten years passed before medical dispensaries, known as “provisioning centers,” opened. This gap and the ability to self-cultivate spawned a robust gray market in the state, with a particular emphasis on Michigan-grown cannabis rather than “exotic” imports from the West Coast. When adult-use cannabis opened in December 2019 with low barriers to entry and no caps on licenses, many operators were able to get involved in the legal market. Today, 672 unique dispensaries serve the cannabis consumers of Michigan, a per capita of 15,900 dispensaries per resident.

Michigan: 1 dispensary per 15,900 residents

Illinois

Illinois took a more controlled approach to legalization than Michigan. The state legalized a purchase-only medical cannabis market in 2015, regulating the sale of cannabis at 55 medical dispensaries. Illinois became the first state to legalize adult-use cannabis via its legislature, allowing regulators to designate a specific number of cannabis businesses that could operate. Six months after legalizing adult-use cannabis, existing medical operators could open their doors for recreational sales in January 2020. Only 55 more dispensaries have opened since, leaving a state of 12.7 million people with only 110 dispensaries, putting Illinois at one dispensary per 115,000 residents.

The barriers to entering the Illinois market are among the highest in the nation. Illinois awards its limited licenses via a point-based scoring system. In addition to early COVID-era delays, issues implementing scoring and lawsuits debating the fairness of this system have caused long delays in licensing. The summer of 2022 saw a wave of conditional dispensary license releases, bringing the potential number of dispensaries to 177. However, with business owners strapped for capital after the delay, time will tell how many new dispensaries will actually open in the coming years.

Illinois: 1 dispensary per 115,000 residents

How do dispensaries-per-capita ratios impact consumer experience? Fewer dispensaries mean fewer options and possibly traveling longer distances to obtain the desired product. In Illinois, the top two reasons consumers list as why a dispensary is their favorite is “the location” and the “variety of products.” In Michigan, 40% fewer consumers list each reason as a determining factor of favoritism. With drastically fewer operators in the state, Illinois cannabis shoppers must consider simple features like location and variety more than their Michigan counterparts.

.png?width=826&height=620&name=Charts%20(2).png)

Retail Brands in the Funnel

In Michigan, the brands with the most Awareness, Consideration, Purchasing, and Loyalty see a higher percentage of consumers in each metric than in Illinois. The two retail brands in Illinois with the most Purchasing in the past six months – Sunnyside and Ascend - see Purchasing from 11% and 8% of Illinois consumers, respectively. In Michigan, the top two brands – Lume Cannabis Co and Skymint - see Purchasing at 15% and 13%, respectively.

Illinois cannabis retailers can each have a maximum of 10 dispensaries in the state, but no such regulation applies in Michigan. Retailers in Michigan who can raise capital through successful sales and investments can expand as they please in the state. Lume Cannabis Co currently has over 30 dispensaries in Michigan , though some have closed while others continue to open. The sheer number of dispensaries Skymint and Lume Cannabis Co are able to open allows them physically reach consumers easier than the retail brands of Illinois. And being physically available to consumers is the first (and essential) step in converting consumers from Unaware to Loyal.

Spend by State

The most striking difference to consumers when shopping between the Illinois and Michigan cannabis markets is price. The cost of cannabis in Michigan is significantly lower than the price in Illinois for many reasons. First, the tax on cannabis in Illinois is one of the highest in the nation, with every step of the way taxed. To meet target profits despite the taxation, retailers in Illinois sell cannabis for prices higher than the industry standard for virtually every product type. Consumers then have to pay an additional tax of upwards of 30% depending on the product type and location where it’s bought. 3.5 grams of cannabis flower will cost around $60 before tax in Illinois; a consumer can get four times the amount – 14 grams - for that price in Michigan.

Why does cannabis cost so much less in Michigan? The state’s approach to licensing has allowed fierce competition to take its course. With so few players in the Illinois market, an elevated budget pricing tier has been maintained. Edibles, for example, are priced starting at $25 to $30 per 100mg across the board in Illinois. In Michigan (and most other competitive markets), we see a tier of edibles below this price point, with 100mg packages commonly priced around $10 - $15. Genuine competition pushes all Michigan dispensaries to have edibles available at this tier. In a limited license market, the limited operators can keep prices high to maximize profitability rather than consumer affordability.

However, Michigan’s prices are particularly low due to an impending oversupply of cannabis flower. The state’s approach to unlimited licensing allows competition to take its course – and competition in cannabis often becomes a race to the bottom. With more new grower licenses than dispensary licenses, prices have steadily dropped over the past six months (per US Cannabis Distribution Trends data) as cultivators compete for shelf space. Michigan consumers enjoy prices nearly as low as those in the long-standing West coast markets of Washington and Oregon. While this is great for consumers, it can damage cannabis companies’ bottom line.

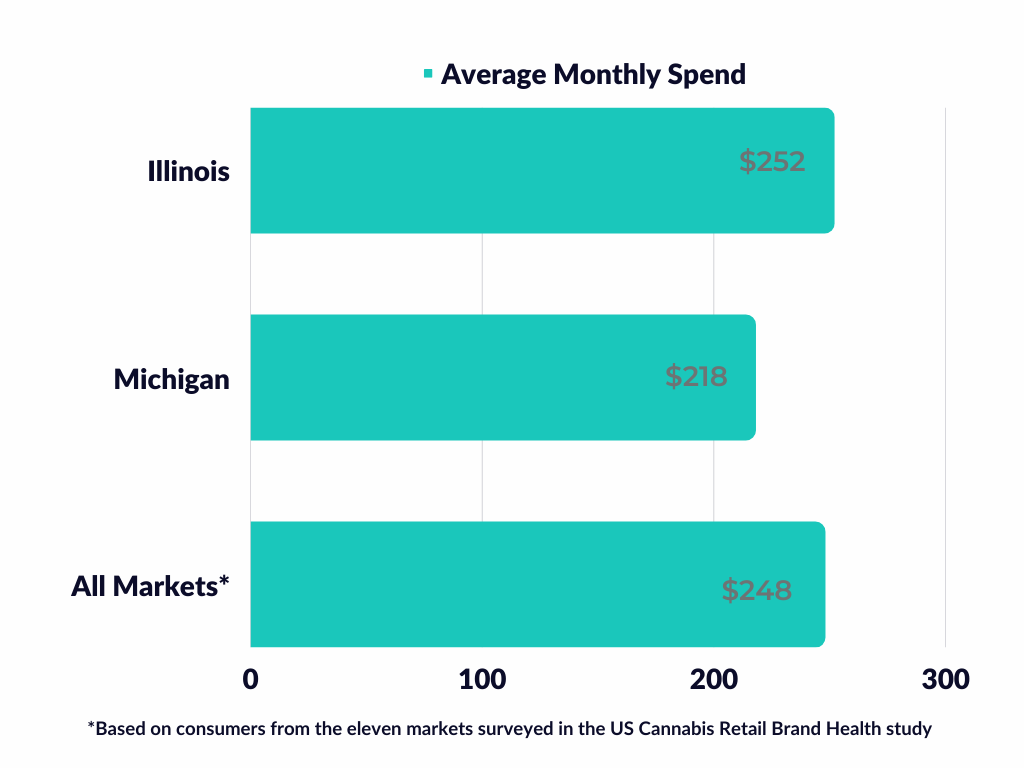

So, when looking at what consumers in Michigan and Illinois are spending, it’s logical to see that Illinois cannabis shoppers are spending more. Illinois consumers report spending $11.56 more per product – and this metric does not account for pack size. Monthly, Michigan consumers spend an average of $218 per month, while Illinois consumers spend $252. And when we look at the consumers who spend over $350 per month, this group in Illinois averages a total of $550 per month, while in Michigan, they average $465.

Conclusion

State-level data on the market one operates in is essential for success in U.S. cannabis, but even more meaningful insights can be gleaned when comparing market to market. Especially for retail brands ready to expand outside of their state, knowing why retailers are winning in the most competitive markets can help inform everything from in-store design to acquisition activity. With Brightfield Group's Retail Brand Health Tracker, cannabis dispensaries of all sizes can amplify point-of-sale data by tracking consumer sentiment across the sales funnel. This new perspective helps retailers strategically allocate budgets to increase sales, drive repeat customers, and build long-term loyalty. Give us just a few minutes, and we'll show you how to map growth opportunities in today's crowded cannabis market with Brightfield's Brand Health Tracker.