Top Cannabis Candy Flavors

-

Caramel/Raspberry (12.7%)

-

Grape (9.6%)

-

Watermelon (6.9%)

-

Chocolate/Strawberry (6.8%)

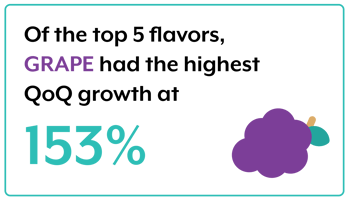

The list of the most popular cannabis candy flavors includes some staples which you might expect. Caramel and raspberry top the bunch, while other fruit flavors like grape and watermelon follow suit, with chocolate rounding out the bottom in with strawberry for retail presence. However, while most flavors of cannabis candy stagnated in quarter over quarter growth during the start of 2020, grape truly thrived.

Flavor Trends in Luxury Products

Grape is the only flavor in the top five which saw a significant increase in retail presence during the first quarter of 2020. Whereas most products are typically available in relatively equal levels across all pricing tiers, grape skews heavily towards “luxury,” with over half of grape products falling into the most expensive classification.

Grape is the only flavor in the top five which saw a significant increase in retail presence during the first quarter of 2020. Whereas most products are typically available in relatively equal levels across all pricing tiers, grape skews heavily towards “luxury,” with over half of grape products falling into the most expensive classification.

Though not in the top 5, the flavor of candy which saw the most overall growth, grapefruit, is also primarily available at luxury price points. The ballooning of these specific, typically more expensive flavors is consistent with the wider trend of premiumization in the cannabis market. As the market is maturing, the average price per unit is continuing to increase, and increasingly more luxury items are driving growth in the market as consumers are comfortable spending more on the products they enjoy.

Flavors which are primarily available at lower price points tend to be losing retail presence – a trend which holds for the entirety of the top five with the exception of grape. This is likely due to increased competition for shelf space at lower price points – these tend to see a greater degree of fluctuation each quarter, with many products slightly gaining or losing market share, while there are less competitors as the price begins to go up, making it easier to break through at these price points.

This shift towards luxury products and flavors has coincided more people using edibles positioned for Relaxation rather than for Fun or Medicine. While these latter two positionings saw items with such branding lose retail presence in the first quarter of 2020, Relaxation grew significantly – and even more so when considering only expensive cannabis products. This indicates that a large number of people who are going to retail searching for relaxation-branded products are willing to drop large amounts of money on their desired products, while the relative number of those seeking to use cannabis candies for fun is decreasing. Thus far, grape products have been at the forefront of these trends, while the other top flavors are missing out in comparison.

Disruptive Flavors as an Indicator for Innovation

Even though the bulk of grape’s growth is occurring at expensive price points, such products have been gaining retail space across all pricing tiers – indicating that it is a general disruptor that has been largely ignored by the cannabis industry until recently. This increase demonstrates that businesses are actively looking for underrepresented flavors so that they can offer a greater variety of products to their customers, and that consumers at large may not be flavor-loyal.

Based on their distribution share towards the end of 2019, it can safely be said that the bulk of the top five flavors – caramel, raspberry, watermelon, chocolate, and strawberry – are well established. Many of them are among the most popular non-cannabis candy flavors. However, their decline and rapid growth of flavors such as grape indicates that consumers want a little variety in their cannabis candy and that retailers are willing to rotate in new flavors in order to satiate and capitalize on this demand. Barring a large shift in consumer preference, it is likely that most of these top five flavors have reached their highest retail capacity. The real challengers to their shelf space are items which grab the eye of consumers by being different from the rest.

Last Updated: May 4, 2020