In today's health-conscious world, protein has become a buzzword, with consumers actively seeking out high-quality options to support their fitness goals and overall well being.

Market trends in America for protein show powders and bars are a quick and convenient way consumers are meeting their daily protein requirements. Brightfield Group’s consumer insights platforms integrated with social media data allow us to get deep into consumer purchasing trends.

In this post, we'll dive into social listening consumer data and consumer insights to explore the protein product landscape. We’ll explore who uses protein products and why, plus the most innovative brands in the space already part of these protein market trends.

Understanding the Protein Product Landscape

When it comes to protein products, protein powder and protein bars are two of the most popular options on the market. Protein powder comes in a variety of forms, including whey, casein, and plant-based options like pea and soy protein.

Protein bars, on the other hand, offer a convenient and portable way to consume protein on-the-go. They are available in a wide range of flavors and can be made with either whey or plant-based protein. Some brands offer both types of options.

Other popular protein products include protein cookies, ready to drink protein shakes and even protein junk foods like these protein cheese puffs or this protein cereal.

All of these products have grown in popularity in recent years as consumers prioritize healthy living and fitness. As a result, the demand for protein products has increased dramatically.

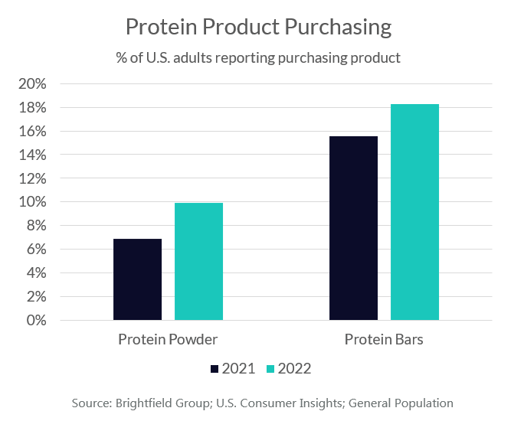

According to Brightfield Group's consumer insights panel data, consumers are still buying protein products in droves. Despite a 40% decrease in purchases of protein junk foods like cookies or pancake mixes, the number of consumers who purchased protein powder increased by almost half from 2021 to 2022. Similarly, there was also a 12% increase in the number of consumers who reported buying protein bars.

While a significant portion of this growth can be attributed to the rise of fitness culture and wellness trends, the increase in demand even during economic downturns—have made it clear that consumers see these products as essential items on their shopping lists. With more consumers seeking out high-quality protein options to support their goals, these insights suggest a long-lasting shift in consumer buying habits.

Understanding the Demographic of Protein Product Users

Protein products have a broad appeal, with consumers of all ages and backgrounds incorporating them into their daily routines. However, Brightfield Group consumer insights reveal that a majority of protein product users are millennials and younger generations, who prioritize health and wellness in their lifestyles. While these consumers tend to split down the middle on gender breakdowns, they are more likely to be upper income and highly educated.

Protein product users are also more likely than the average American to be health-conscious with a focus on whole body well-being. This can be attributed to the fact that these products serve as a convenient way for consumers to incorporate plant-based protein into their diets without having to cook or prepare it themselves.

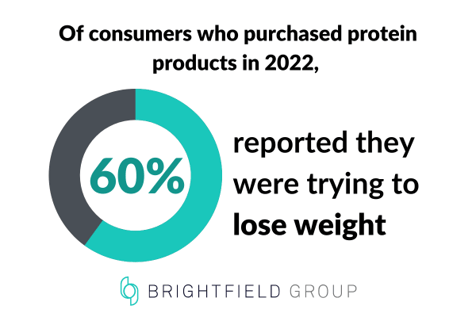

Additionally, protein product consumers tend to be more active and interested in fitness, with a higher likelihood of engaging in physical activity. This is likely due to the fact that protein products are marketed as being good for fitness, weight management, and muscle development. These consumers are looking for convenient foods that allow them to meet their health goals. In fact, 60% of consumers who purchased protein products in 2022 also reported that they were trying to lose weight.

Identifying the Right Time to Engage Consumers

Social listening data reveals that consumers are most likely to search for protein products during times of transition, such as starting a new workout routine or adjusting to a new diet. Additionally, peak search times tend to align with key wellness moments throughout the year, such as the start of a new year or the summer months leading up to beach season.

As people returned to their normal workout routines in 2021, consumers talked online about protein bars and milk-based powder. However, mentions for both product types have increased over the past 6 months—with a noticeable absence of chatter about plant-based protein powder.

While plant-based protein powder had been gaining traction in 2021, there was a noticeable drop off in searches for this product type in 2023. It’s important to note that the many plant-based products have seen a decline in interest over the last few years, which could explain why consumers weren’t talking about plant-based protein powder as much.

Top Hashtags for Protein Products

Social media has become a key platform for protein product brands to engage with their consumers. Hashtags like #fitness, #healthylifestyle, and #nutrition are just a few of the top-performing options for reaching protein consumers.

While the top hashtags for protein products are similar to those for other health and wellness categories, there are a few that stand out as unique. For example, #mealplanning and #healthyrecipes are not only popular in general but also specifically among protein consumers.

.png?width=500&height=333&name=protein%20on%20the%20rise_assets%20(1).png)

Given the popularity of food-related content among these audiences, brands in this space may want to consider leveraging user-generated content (UGC) or influencer partnerships to showcase recipes featuring their products—and connect with consumers on a more personal level.

Innovative Brands to Watch

The protein product industry continues to grow, fueling innovation in the market and prompting new offerings from established brands. Protein powder trends move fast, so the brands popular today need to keep up to still be on the rise tomorrow.

Brands like Dymatize, Ghost, RYSE, and Naked Nutrition are disrupting the market with high-quality, protein options that resonate with today's health (and taste) conscious consumers.

Dymatize broke the internet in 2020 when it released its Fruity Pebbles and Cocoa Pebbles flavored whey protein powders. In addition to containing ISO-100, a lean protein powder with as few carbs as possible, the brand has gained a new following of protein consumers who also want to enjoy the flavors of their protein powders.

Ghost Whey Protein Powder is another brand that has leaned into elevating the flavors of their protein powders.The brand combines a whey protein blend and real CHIPS AHOY! cookie pieces for a flavor that has enabled them to build a cult following of enthusiasts.

Ghost Whey Protein Powder is another brand that has leaned into elevating the flavors of their protein powders.The brand combines a whey protein blend and real CHIPS AHOY! cookie pieces for a flavor that has enabled them to build a cult following of enthusiasts.

Licensed flavors are expected to become a significant portion of the protein product market, and Ghost and Dymatize have shown how successful such innovations can be.

Additionally, brands are incorporating trendy ingredients like collagen and probiotics to provide additional health benefits and appeal to consumers seeking out functional foods.

RYSE Loaded Protein and Naked Nutrition are two other brands that are disrupting the market with innovative ingredient additions. RYSE combines whey protein with wellness ingredients such as prebiotic fiber and MCTs – creating a product that satisfies multiple needs for their consumers.

Similarly, Naked Nutrition brands their protein powders as “completely free of additives and artificial sweeteners”. They also source their whey from small farms – touting the highest quality cows and dairy products.

As the protein product industry continues to grow, there are exciting opportunities for innovation and new product development. By leveraging social listening data and engaging with consumers through strategic social media campaigns, brands in the protein product space can capitalize on this trend and tap into the growing demand for high-quality protein products.

Published 4/18/2023