Arthritis isn't just an old-age issue anymore. It's spreading fast, and the numbers are there to prove it. The CDC's conservative count says 54 million Americans suffer from the condition, but the Arthritis Foundation points to a staggering 91 million. What's going on? Not only are the aging baby boomers and Gen Xers suffering from arthritis, but Millennials and Gen Z are now in the mix, reporting arthritis and joint pain at rates that defy old stereotypes.

The buzz around arthritis hasn't wavered much in social channels, but what's being talked about is changing. While turmeric and curcumin have long dominated conversations around natural pain relief, there's a new wave of interest in alternatives like Irish Moss. These shifts in chatter are more than noise—they're signals pointing to changing consumer behaviors and emerging market opportunities.

Let’s explore what's happening with arthritis today and how the wellness industry can stay ahead.

Which Generation Has the Most Joint Pain?

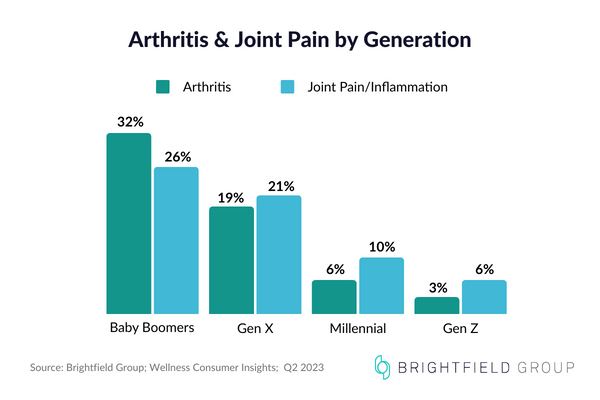

Forget the old playbook where arthritis was a condition reserved for the retirement crowd. Brightfield Group Wellness Consumer Insights data reveals that this assumption isn’t true. Baby Boomers are leading the pack with 32% reporting arthritis, fitting the expected trend. But millennials, currently aged 27 to 42, see 6% arthritis prevalence and 10% experiencing joint pain. And don't count out Gen Z—they're starting to show signs too, with 3% already dealing with arthritis and 6% battling joint pain. Meanwhile, Gen X shows a balanced 29% dealing with arthritis and 26% with joint pain.

This isn't just a random spike; it's a consistent trend built over time. The data reveals a starting problem our younger populations are facing. The question now is, what's causing this shift? Is it all about lifestyle, or is there more to the story? And more importantly, what does this mean for businesses in the wellness space looking to address these concerns?

These aren't just flukes or bad genes at work. We're looking at a widespread shift in people's day-to-day lives. For baby boomers, traditional risk factors like age and years of wear and tear contribute to their 32% arthritis rate. But when 10% of Millennials are dealing with joint pain, it's time to look beyond the calendar.

This points to lifestyle—not just age—as a key player. Less exercise, more screen time, and diets that could use a serious overhaul likely contribute to this issue. The stress of daily life also piles on to the problem. Recent medical research indicates a connection between stress and inflammation, the primary symptom of arthritis and joint pain. Chronic stress can exacerbate inflammatory responses, leading to heightened pain in arthritis sufferers.

The implications are massive for the wellness industry. It's not just about addressing the symptoms anymore; it's about getting to the root of the problem with lifestyle innovations.

Arthritis on Social Media

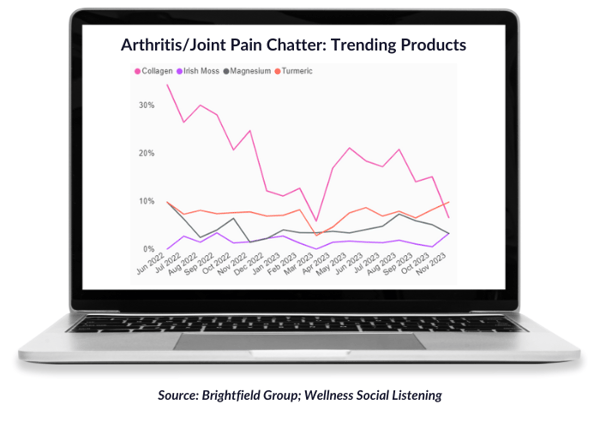

Arthritis garners steady chatter on social media as people commiserate on the effects and seek relief. However, the type of products that are catching attention shift over time. Collagen was the all the rage among joint pain and arthritis conversations across 2022, with 30% of all conversations tracked on the topic mentioning collagen in August 2022! However, trendier ingredients for joint pain relief made their way into conversations in 2023 – including turmeric, magnesium, and Irish Moss. A look at the last 18 months of social data via Brightfield Group’s Wellness Social Listening data reveals the shift.

Consumers are diversifying their wellness toolkits, looking past the well-trodden paths and checking out new, niche, lesser-known options. It should be a wake-up call for brands that the market is ripe for innovation and there's room for new solutions to old problems.

The big question is, what's driving this shift? Are consumers simply bored with the same old supplements, or are they searching for something more — perhaps a product that matches their lifestyle and wellness philosophy? Whatever the reason, the chatter points to a market that's moving fast.

For the wellness industry, this isn't just chatter; it's actionable intelligence. Brands that tune into and align with these conversations can tap into new demographics. It's about keeping a finger on the pulse of social discourse, understanding it, and using it to forecast trends before they become yesterday's news.

Tap into Brightfield Group’s Wellness Social Listening + Consumer Insights to be ahead of the curve with what’s next in wellness.

Published: 11/30/2023