In this Post: |

Published |

| Social Listening Reveals: The Mushroom Boom | August 2023 |

| 2023 Consumer Wellness Trends | June 2023 |

| Trending Products: Collagen, Prebiotics, and Wine | April 2023 |

Social Listening Reveals: The Mushroom Boom

In the digital age, social media is a powerful platform for shaping conversations and trends. A growing topic of conversation: mushrooms. Brightfield Group's U.S. Wellness Social Listening portal has caught the pulse of this emerging phenomenon, with mushroom varieties like Chaga, Reishi, and Lion's Mane gaining substantial traction in online discussions. This surge shows growing interest in the potential wellness benefits of these mushrooms as well as more companies differentiating with these ingredients.

Tapping into the Mushroom Mania: Data Snapshot

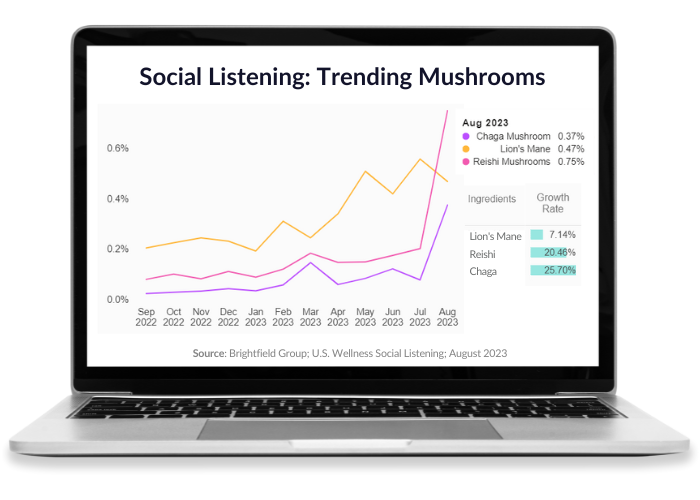

Mushrooms are having their moment online. According to the Brightfield Group's insights, online chatter surrounding Chaga, Reishi, and Lion's Mane mushrooms has witnessed significant year-over-year growth. Chaga led the pack with a 26% rise in conversations, reaching its peak in July 2023. Reishi followed closely with a 20% surge, capturing the spotlight in August 2023. While Lion’s Mane chatter grew by 7%.

As of August 2023, Lion's Mane commands a 0.47% share of voice, Chaga captures 0.37%, and Reishi reigns supreme with 0.75%. These numbers are more than just percentages; they reflect an intricate interplay of consumers and corporate entities engaging in conversations and promoting these mushroom varieties.

The Mushroom Buzz: Purported Effects & Need States Driving the Trend

What’s behind this mushroom mania? The driving force seems to be the potential wellness benefits these mushrooms offer to consumers in distinct need states. Each variety brings its unique set of properties to the table:

- Lion's Mane is celebrated for its potential cognitive benefits. Often referred to as the "smart mushroom," it's believed to support brain health and cognitive function. This ingredient appeals to consumers within the focus and brain/mental health need states.

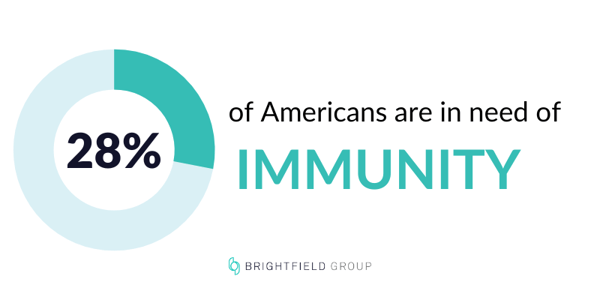

- Chaga mushrooms are valued for their potential immune-boosting properties. This mushroom is thought to contain powerful antioxidants that can support overall well-being, appealing to consumers in the immunity and holistic wellness need states.

- Reishi mushrooms have gained popularity as an adaptogen. It is said to assist the body in managing stress and promoting balance, so it appeals to American consumers needing relaxation. Some also purport it's linked to potential immune support.

Mushroom Moment: A Blend of Consumer Voices and Corporate Influence

This trend is not solely driven by health-conscious consumers. Corporate entities are playing an active role in shaping the conversation through advertisements and company posts. This combination of individual interest and commercial influence creates a holistic discourse that's both intriguing and informative.

Getting into this mushroom movement, it's clear these fungi are more than just culinary ingredients. They're shaping conversations, generating buzz, and highlighting the evolving landscape of wellness.

PREVIOUS WELLNESS TRENDS

What's Driving Product Trends? Consumers Striving for Wellness

JUNE 2023

The pursuit of a healthier and more balanced life has taken center stage for many Americans. Looking at Q1 2023 U.S. Wellness Consumer Insights data, we delve into the trends capturing the attention (and wallets) of consumers. We’ll explore the realms of sleep trends, mental health, gut health, and focus enhancement, where consumers are still eagerly investing their hard-earned dollars.

High Quality Worth The Cost

Our most recent wellness survey data shows that 56% of American consumers are buying less expensive items and that 40% are buying fewer health and wellness items overall. While consumers may be tightening their proverbial purse strings to save money, Brightfield Group data also suggests that they are willing to spend more on high-quality, long-lasting products. Our data shows a recent increase in consumers saying high quality is worth the cost – up to 67% in Q1'23 from 64% in Q4'22.

Sleep Aids: A Gateway to Rejuvenation

.png?width=349&height=232&name=In-Blog%20Asset%20(9).png) In today's fast-paced world, sleep has become a precious commodity. Science is showing that getting enough sleep is the single most important thing you can do to improve your well-being and ensure that you stay physically and mentally healthy - even above diet and exercise. Brightfield consumer insights data shows sleep as a growing priority for nearly 3 out of 4 Americans! That’s unsurprising considering that 22% of Americans (up from 20% in Q4 2022) say lack of sleep is one of their main causes of stress.

In today's fast-paced world, sleep has become a precious commodity. Science is showing that getting enough sleep is the single most important thing you can do to improve your well-being and ensure that you stay physically and mentally healthy - even above diet and exercise. Brightfield consumer insights data shows sleep as a growing priority for nearly 3 out of 4 Americans! That’s unsurprising considering that 22% of Americans (up from 20% in Q4 2022) say lack of sleep is one of their main causes of stress.

As the awareness of the importance of restorative slumber grows, consumers are actively seeking innovative sleep aids to enhance their sleep quality. From smart mattresses and brown noise machines to CBN products and tech-y alarm clocks, the market for sleep aids is flourishing. Tapping into this category offers immense potential for providing products and services that help individuals achieve optimal rest and wake up refreshed.

Gut Health: Nurturing from Within

The old adage "you are what you eat" has taken on a whole new meaning with the rising interest in gut health. Consumers have become increasingly aware of the vital role the digestive system plays in their overall well-being. Brightfield consumer insights show that nearly half of consumers believe that gut health affects wellbeing, and this idea has been growing – up to 53.6% in Q1 2023 from 48.1% in Q2 2022.

As a result, they are actively seeking out products that promote a healthy gut microbiome, such as prebiotics, fermented foods, and kefir products. The conversation has continued over to social media, with #guttock being one of the top trends on TikTok in 2022 with almost 728 million views! This category presents a fertile ground for marketers to develop products that support gut health and address the growing demand for digestive wellness.

Mental Health: Prioritizing Emotional Well-being

In recent years, the conversation around mental health has gained unprecedented momentum, and consumers are now more invested in their emotional well-being than ever before. In a post-pandemic world, the focus on mental health has become even more normalized, with more and more companies and schools recognizing the need and approval of taking mental health days. Almost a quarter of consumers say they suffer from anxiety, making it the top condition plaguing Americans. When looking at Gen Zers, anxiety jumps up to 35%!

.png?width=600&height=400&name=In-Blog%20Asset%20(10).png)

Interestingly, our data shows an increase in consumers engaging in proactive methods (rather than more traditional reactive methods) to attempt to keep these mental health conditions in check. Examples include exercise and dietary supplements that are known to assuage anxiety.

This shift in mindset has led to a surge in demand for products and services that promote mental wellness. From online therapy platforms like BetterHelp to microdosing psychedelics, consumers are exploring a multitude of options to prioritize their mental health. Americans are also looking to proven wellness tactics in addition to new methods – our data is also showing increases in micro-workouts and decreases in alcohol consumption as part of a proactive mental healthcare practice. This category opens up a vast landscape of opportunities to develop solutions that foster emotional resilience and provide support during challenging times.

Focus Enhancement: Unlocking Productivity Potential

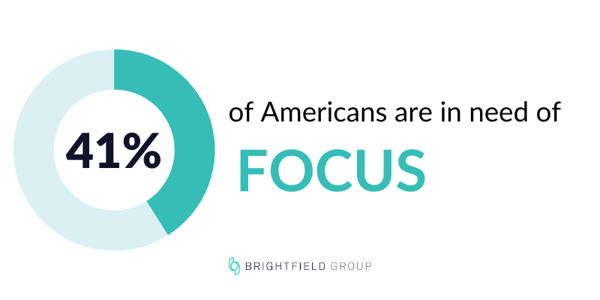

In an era of information overload and constant distractions, consumers are on a quest to enhance their focus and maximize productivity. According to our data, 40% of Americans say staying focused is difficult. This is especially true for millennials, 55% of whom say they find staying focused difficult. Additionally, 83% of consumers who find it hard to stay focused also report feeling anxious and stressed out.

This societal lack of focus has given rise to a range of focus-enhancing products, including nootropics, mindfulness apps, and productivity tools. By understanding the needs and desires of consumers in this category, marketers and product innovation professionals can create solutions that help individuals unlock their cognitive potential and achieve greater levels of focus and concentration.

As the wellness landscape continues to evolve, consumers are investing their resources in the pursuit of a healthier, more balanced life. The categories of sleep aids, mental health, gut health, and focus enhancement stand out as the top contenders for consumer spending in 2023. By staying attuned to these emerging trends, providers in the wellness space can seize the opportunity to develop impactful and relevant products and services that cater to the evolving needs of wellness-conscious consumers.

Trending on Social Listening: Collagen, Probiotics/prebiotics, and Wine

APRIL 2023

Collagen

What is collagen?

Collagen is a protein that helps give strength and elasticity to skin, bones, tendons and other tissues. It's found in the connective tissue of animals (and humans).

The benefits of collagen for wellness include:

- Improved skin health

- Reduced wrinkles

- Joint health

Who uses collagen?

The average consumer who uses collagen products is a middle-aged, educated, and affluent woman looking to enhance her skin and hair. Collagen consumers heavily skew female and married with adult children. Many of these collagen buyers are either Gen X'ers or older millennials. They are typically concerned with functional health, digestive health, and holistic wellness.

While these consumers are not usually the first to try new diets or wellness trends, they tend to be fairly health-conscious and practical. Those who buy collagen are likely to fall in Brightfield’s complex consumer group 'Better-Way Believers'. This segment tends to wait on the sidelines to see what’s really working before jumping on board themselves. By innovating to create products this group is already familiar with, brands can appeal to this audience's existing expectations—and build brand loyalty.

Collagen Social Media Buzz

Trending hashtags for collagen include several that you can use to find more information about the benefits of collagen. The most popular include #collagen, #beauty, #reviews, #vegan and #antiaging. Consumers are turning to these hashtags to learn more about various collagen products. They are sharing reviews and discussing different applications for the products.

There are many exciting brands engaging with buyers on social media.

SkinTe is the first ever sparkling beverage infused with collagen, which improves skin elasticity and gives a boost to overall well being. Branding themselves as a fun and innovative way to consume collagen, the brand is using novelty to engage consumers on social media.

SkinTe is the first ever sparkling beverage infused with collagen, which improves skin elasticity and gives a boost to overall well being. Branding themselves as a fun and innovative way to consume collagen, the brand is using novelty to engage consumers on social media.

Evolution_18, a beauty brand founded by Bobbi Brown, offers customers bovine-based collagen powder as another option for skin and hair care. This brand has taken advantage of influencer buzz to reach new audiences on social media.

Prebiotics/Postbiotics

What are prebiotics/postbiotics?

Prebiotics and probiotics both fall under the umbrella term "probiotic" because they both contain beneficial bacteria that help improve digestive health. They're found in foods like legumes, whole grains and raw honey--and can also be taken as supplements.

Who's using prebiotics/postbiotics?

Women aged 35-54 are the primary users of prebiotics/postbiotics, with women aged 50 and above coming in second. Although women comprise the majority of prebiotics/postbiotics buyers, a strong segment of male consumers (36%) also comprises the total makeup of buyers.

Prebiotics/postbiotics buyers over-index for upper income levels and high levels of education. They also tend to be health conscious people who are highly concerned with digestive health, functional health and immunity. This demographic tends to not only use trendy products but also take supplements regularly (especially probiotic ones) as part of their daily routine.

Prebiotics/Postbiotics Social Media Buzz

Trending hashtags for prebiotics and probiotics include: #probiotics, #guthealth, #immunesystem, #healthyliving, #shopping and #wellness.

With many different prebiotic/postbiotic product types, brands may have trouble differentiating themselves in this product category. There are a few brands successfully creating a lane for themselves in this space.

Seed is a science-forward probiotics brand that develops research-backed probiotics for outcomes across gastrointestinal, dermatological, oral, pediatric, and nutritional health. Their DS-01 Daily Synbiotic is a 2-in-1 probiotic and prebiotic formulated to support systemic health. By leaning into the science and creating content that speaks directly to consumers, they have built a robust social media presence.

Seed is a science-forward probiotics brand that develops research-backed probiotics for outcomes across gastrointestinal, dermatological, oral, pediatric, and nutritional health. Their DS-01 Daily Synbiotic is a 2-in-1 probiotic and prebiotic formulated to support systemic health. By leaning into the science and creating content that speaks directly to consumers, they have built a robust social media presence.

Because these consumers are looking for convenient, easy to carry ways to consume probiotics, there are also several probiotics drink brands making a name for themselves in this space. Brands such as Humm Probiotic Seltzer, Culture Pop Grapefruit Soda and Poppi Prebiotic Soda are taking over a space previously occupied by larger more well-known brands. Using sleek packaging, exciting branding and social media content, these brands are using social media to directly engage with customers.

Wine

Wine and Wellness

While wine may not be a typical "health product" many people are now choosing to enjoy wines in ways that connect them more closely with their health and wellness goals. Wine brands are building new product lines for these consumers including organic wines, biodynamic wines and natural wines.

Made with minimal intervention and no added sulfites, these wines also tend to have a lower alcohol content than conventional wines. These wines are also better for the environment because there are fewer chemicals used during production and transportation of these products. We'll use the term 'natural wine' to refer to wines in this category.

Who is Drinking Natural Wine?

Consumers who are interested in natural wine tend to be older, and well-educated. They also tend to live in urban areas and have higher income levels than average Americans.

The lifestyle associated with natural wine is characterized by an appreciation for the environment and a desire for healthy living. These consumers are likely to fall into the functional health needs state, which means they are focused on wellness as a complete lifestyle. Brightfield Group’s consumer insights platforms include need states like functional health to reveal unique CPG consumer insights.

Wine Social Media Buzz

Trending hashtags wine include: #wine, #lifestyle, #healthylifestyle, #natural, #healthylifestyle, #food, and #selflove

Wine brands are using social media to understand what consumers are thinking about the category, and uncover new trends that may not have been on their radar before.

One such brand making a splash on social media is Tablas Creek which uses Instagram to respond to comments and messages from their fans. Their friendly, conversational style of writing is the perfect vehicle for their brand’s storytelling.

Walsh Family Wine is another wine brand using authenticity on social media to connect with consumers. Their digital presence uses behind-the-scenes moments at their tasting room and virtual wine tastings to engage their audience. By maintaining a fun and approachable tone, this brand has developed a local cult following on social media.

Looking Forward

Regardless of the specific wellness product, brands are leveraging social media to build brand awareness and loyalty as well as drive sales of existing products. Using Brightfield Group's consumer insights to create content that resonates with their audience, brands can take part in the social media conversation around collagen, prebiotics/postbiotics and wine.

Updated: 08/09/2023

.png?width=680&height=170&name=Blog%20CTA%20(9).png)

.png?width=479&height=479&name=Charts%20for%20Blogs%20(1).png)

.png?width=680&height=170&name=Blog%20CTA%20(7).png)

.png?width=680&height=170&name=Blog%20CTA%20(8).png)