The United States and Canada are two of the largest legal cannabis markets in the world. They face unique issues, whether it's the US Food and Drug Administrations inaction on comprehensive CBD regulation, or the wide range of provincial regulations. Each market has had its wins too. US CBD is entering the mainstream through mass retailers and as an additive in familiar products like drinks, lotions, and capsules. Canada had initial challenges with product limitation and with the launch of Cannabis 2.0, more products have entered the fold, fueling branding opportunities and new entrants to the market.

As these markets expand, so do the brands that define them. How have these brands performed in their early start and what can we expect in the future?

We began tracking the brand health of the US CBD market in 2019, and have now expanded to track the developing Canadian market. With the challenges each market faces, we take a look at how brand awareness differs between these two markets.

Beyond – and reflected in – their market-leading revenues, Canadian cannabis brand leaders (LPs) like Canopy and Aurora boast a great deal more consumer awareness than smaller brands operating in the space. They’ve also gained more traction than top brands in the US CBD space, though arguably many of the larger brands surged within a roughly similar timeframe in the two markets.

So how have major Canadian players gained such notoriety?

The Canadian Cannabis Market Landscape

Firstly, Canada’s cannabis market is still significantly less fragmented than that of US CBD – there are hundreds of companies in the space, not thousands. The Canadian market’s barriers to entry have prevented less serious players from entering and muddying the landscape, thus each Canadian player has been given a fairer shake at breaking through the pack and making themselves known to consumers.

Furthermore, heavyweight LPs like Aurora took a commanding lead in the Canadian medical space prior to the country’s adult-use market opening. In this system, patients were required to select one LP to order from – essentially making brand awareness and loyalty a requirement – and these LPs later became powerful first-movers on the adult-use market. For this reason, many of these companies’ brand awareness baseline was quite high even before the legal adult-use market opened, and it has only grown from there, with initial momentum continuing to deliver nearly two years after the opening of Canada’s adult-use market.

Comparing Canada Cannabis to US CBD Brand Awareness

In US CBD, however, brands generally had much smaller loyal consumer bases when the Farm Bill passed and CBD went mainstream, preventing them from establishing the same kind of organic following. In addition, since that time customers have had every opportunity to “abandon ship” as thousands of brands have flooded the space since 2018 - some legitimate, safe and high-quality, and many not.

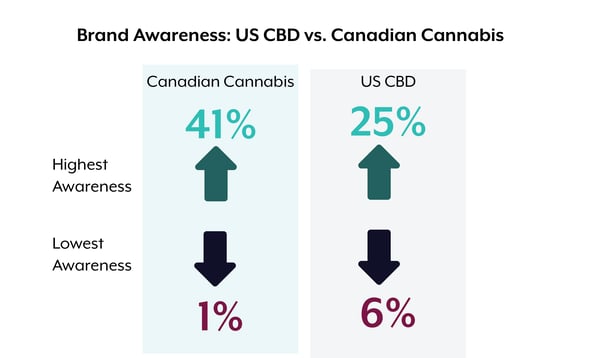

Although bigger Canadian brands have had strong inertia, the unique evolution of the country’s cannabis market has largely consolidated success among these few major players. Today, a huge chasm exists between top and bottom brands on every benchmark (awareness, consideration, purchase and loyalty). But the scene looks extremely different in US CBD, where even the least-known brands have 6% awareness, which is more than the bottom half of Canadian brands have currently. This is likely because US CBD brands have fewer marketing, advertising and retail restrictions as well as greater (non-cannabis) consumer exposure, which has given companies the freedom, platform and necessity to effectively distinguish themselves among various consumer groups with different messaging and positioning.

As Cannabis 2.0 continues to roll out and Canadian brands launch more innovative products, we expect to see early stage conversion metrics like awareness and consideration increase. The real challenge for brands over the next few quarters, for both US CBD and Canada Cannabis, will be developing a consumer-centric approach that fosters deep relationships with loyal, passionate customers. This impacts not only brand awareness strategies but also product development, packaging, shopping experience, and loyalty programs.

Last Updated: 6/19/20