With Canadian cannabis retailers closing their stores, ship-only sales policies, and an unprecedented pop in demand over the past few days, the Canadian market is due to revisit its roots. As Canada expanded its legal-use laws, consumers rapidly shifted their preferences on how, when, and where they buy cannabis. This chapter may be a visit back to the early days of cannabis in Canada.

The Shift to D2C

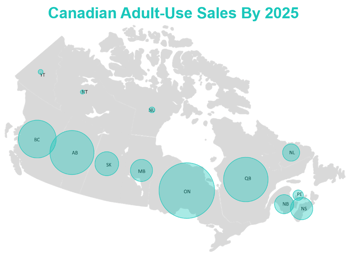

Many provinces instituted direct-to-consumer options from either private retailers or government-run online markets, including next-day or even same-day delivery in some areas, while the territory of Nunavut is 100% ship-only.

Many provinces instituted direct-to-consumer options from either private retailers or government-run online markets, including next-day or even same-day delivery in some areas, while the territory of Nunavut is 100% ship-only.

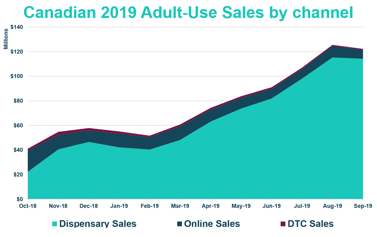

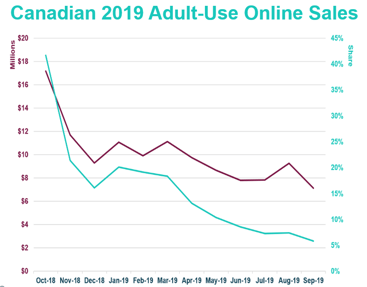

But over the first 12 months of legal adult-use, we witnessed a precipitous drop in online-sales, dropping from over 40% of all sales to under 7% share of sales. Dollars, similarly, dropped, but premiumization throughout the year likely mitigated losses to other channels.

As Ontario and British Columbia begin to come into their own with new infrastructure and capital expenditures, this new, perhaps temporary, paradigm could represent an opportunity for firms and governments to perfect direct-ship methods, perhaps permanently shifting consumer behavior.

We have seen large delivery channels opening this period, legally or illicitly within many mature U.S. states. This may represent the future of cannabis sales as a light-weight product with full menu details easily found on the latest app, lower barriers for small providers and firms, and greatly reduce capital requirements.

Consumer education still greatly benefits from in-store shopping where knowledgeable budtenders can address consumer concerns directly. Canadians also are years away from the dread of craft-beer isle paralysis, where too many options clutter decision-making. Lastly, they have yet to move along the consumer education curve enough to consistently mass purchase online for home-use.

Consumer education still greatly benefits from in-store shopping where knowledgeable budtenders can address consumer concerns directly. Canadians also are years away from the dread of craft-beer isle paralysis, where too many options clutter decision-making. Lastly, they have yet to move along the consumer education curve enough to consistently mass purchase online for home-use.

As the economy continues to respond to the effects of social distancing, we'll continue to watch how these recent supply changes impact the future of market demand and channel dynamics.

Want more on Canadian Cannabis?

Click here to download our Cannabis 2.0: Brand and Product Trends report.

Last Updated: 3/18/2020

All graphs are sourced from Brightfield Group market data