If your product’s end goal is to be in the hands of happy consumers, then you need to know who they are. The pandemic reminded us that a direct relationship with customers is crucial for future-proof marketing strategies – especially in the dynamic cannabis and CBD markets.

But if you’ve made it here, you already know how important it is to foster strong relationships with your customers. So let’s get started.

1. Adopt a Data-Driven Approach to Your CBD Consumers

Data that looks at consumer demographics, usage, and paths to purchase allows you to get a picture of who is actually enjoying your product. Consider adopting a data-driven customer strategy. When using data, your marketing and product strategies are backed up by what is happening in the world, not what we think might be happening. Especially in cannabis and CBD, there’s no shortage of stereotypes that can muddle the reality of modern-day usage. Smart marketers will take the time to uncover who their customers really are.

Where do I get consumer data?

Internal data is a great place to start. Sales data, satisfaction surveys, and even examining your social media following can show you a picture of who you’re selling to. However, that picture looks a lot like this:

And I bet you’re looking for a picture that looks more like this:

With internal data alone, it’s hard to get a crystal-clear idea of your customer. Sure, you may know many of your consumers are male, but does their usage skew light or heavy? Maybe you know how often they purchase your product, but what other product types could your customers be using or looking for? Robust consumer insights on your CBD buyers are the best way to get to picture #2 above.

Here's a hypothetical: A CBD topicals brand has noticed an increase in purchasing among men and wants to deepen this relationship. First, they'll need to understand their other demographics. All men may not be topicals users so it’s important to understand other aspects, which can include:

- Age

- Income

- Political Affiliation

- Gender

- Sexuality

- Marital Status

A strong understanding of demographics lays a great foundation for a consumer-centric brand. Additionally, product usage data is helpful to know which of your products (or other ones in the space) these consumers gravitate towards. Their paths to purchase can then give you another layer with a glimpse at the various ways that your products are helpful to these specific buyers (or even potential target audiences). This all helps inform your channel and marketing strategy by really knowing where, how, and why consumers are buying.

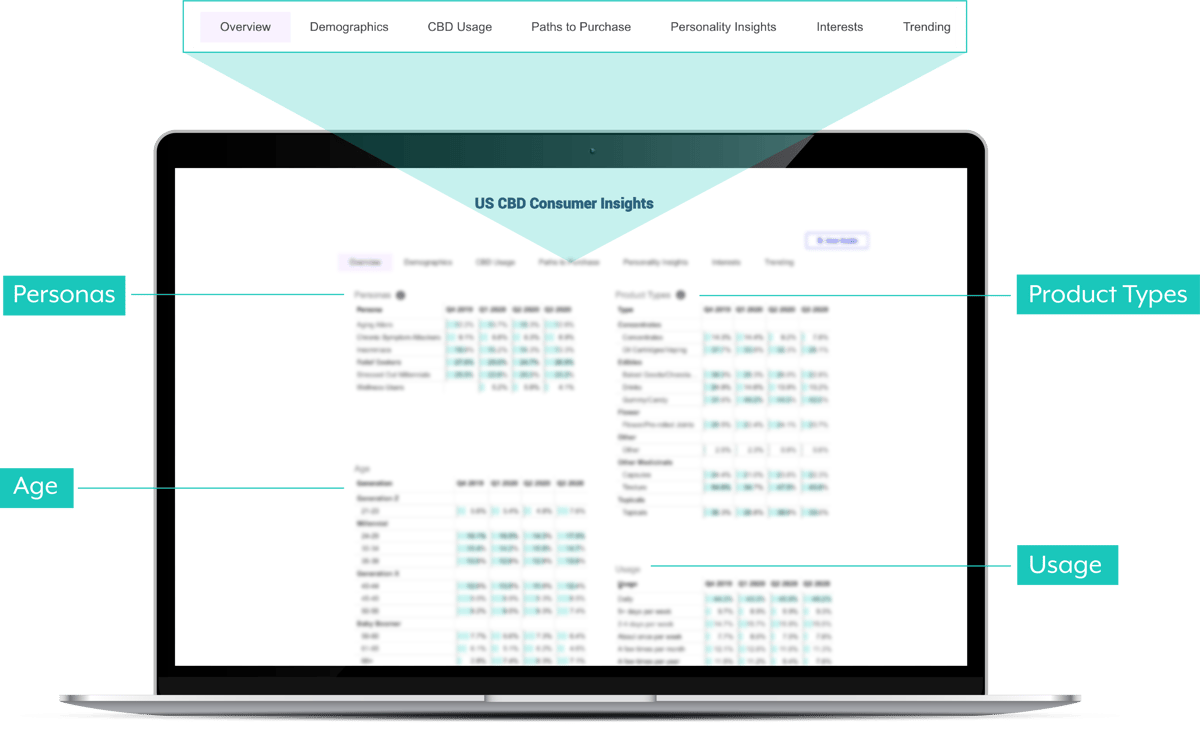

Brightfield’s Consumer Insights portals are simple. Using the filters, you can easily input your desired customer attributes, allowing you to explore who that customer is and how they use cannabis or CBD.

2. Get A Grip on Your Brand’s Health and Perception

Now that we know who your customer is in relation to your product, it’s time to go a step deeper and explore who they are in relation to your brand. At the end of the day, a brand is an emotional perception in the minds of consumers. When was the last time your company reviewed how consumers felt about you? Assessing this, as well as other metrics of your brand’s health, lets you step outside and see yourself from the consumer’s point of view.

One of the easiest ways to see how people talk about your CBD brand is to look at product reviews and social media posts. These sources will show you a glimpse of the most passionate and (possibly) most pissed-off customers you’ve had. However, remember just that — when a consumer takes the time to make a statement, their emotions may not represent how the whole of your customer base feels. For example, a company facing product packaging issues could see an onslaught of negative social media posts despite many consumers seeing past the superficial flaw and enjoying the product.

Brands with enough resources can commission their own brand health studies. These costly endeavors are worth it in the end if done correctly, but beware when going the internal route; rose-colored glasses can turn your report into an unearned success story rather than move your brand towards progress. Though it may feel good to report on how amazing and loved your CBD brand is, without seeing the full, honest story, your company is wasting resources to pat itself on the back for a biased job done.

If you’re looking to skip the hassle, cost, and risk of an internal brand health study, Brightfield Group’s Brand Health portal is up to the task. Our Brand Health portals track the top brands and their purchase funnel through a consumer lens, allowing for deeper competitive benchmarking and brand differentiation.

How do I analyze brand health and perception?

A good initial question to start your brand health research is, “Why don’t our customers love us?”. This question can make you aware of any blind spots you didn’t know you have and uncover areas or products that may need improvement. Providing a solution that directly addresses these gaps — and your customers’ pain points — can mean the difference between a brand that falls flat and one that delights the right consumers.

Then look at satisfaction — ask the question, “How do people view us?” The answers here can uncover aided and unaided attributes that are associated parts of your brand. In order to effectively stand out amongst a sea of other brands, you need to ensure your brand hits on key themes and attributes your consumers care about.

Analyzing consumer perception provides insight into what brings them in, what keeps them interested, and what turns them away. These factors become a crucial part of knowing your strengths versus weaknesses. You’ll also be able to identify what it is about your brand that makes customers loyal and what expectations your consumers have of you.

3. Go Beyond the Tangible — Get to the Emotional

Effectively reaching your audience means knowing where to find them and what gets them to take action. Now we know how your customers feel about your brand and your products, but what do they care about besides cannabis and CBD? Psychographic data explores why your shoppers buy and provides a sharper picture of who they are.

How can you embed your brand in the minds of your target audience? In-depth insights that come from psychographic data can pinpoint opportunities for you to relate to consumers on a fundamental level; through their values, personal preferences, and their motivations to buy CBD products. A good question to keep in mind here is what values do they care about and what do they want from their CBD?

How Do I Find Psychographic Data on CBD Consumers?

A good way to start collecting this kind of data is directly from your clients— via surveys, personal conversations, or social media listening tools. We've mentioned previously that it’s great to use your own customer data to extract insights but that can be a very limiting view. Conducting focus groups is another way to get at the psychology of consumers but that can be really expensive.

Brightfield Group solves for that by getting opt-in social data from our survey respondents, allowing us to use fancy tech, like Natural Language Processing, across thousands of consumers to really understand their psychological profile.

Building strong customer relationships in CBD takes some time and effort.

Once you know which metrics matter and how to begin utilizing the right consumer data, customer relationships start to become a natural part of your overall strategy. You’ll be able to effectively identify specific actions needed to improve and grow your brand following with the right data-driven insights.