Seed oils are no longer just a pantry staple—they’ve become a symbol in the broader clean label conversation. What was once overlooked is now being closely examined by consumers seeking ingredient transparency.

Introduction: The Unexpected Villain in Your Pantry

A few years ago, if you asked someone to name a dietary villain, you’d hear “sugar,” “gluten,” maybe “GMOs.” But now? Seed oils are rapidly climbing the ranks—and the debate is louder than ever.

Celebrities, doctors, wellness influencers—even political figures like RFK Jr.—have weighed in, blaming seed oils for everything from chronic inflammation to national dietary decline. Yet amid the heated arguments, something crucial is happening under the radar: consumers are making quiet but impactful shifts in how they shop, eat, and define "healthy."

And that shift has major implications for food, beverage, and supplement brands.

Context: The Social Spark That Lit the Oil Fire

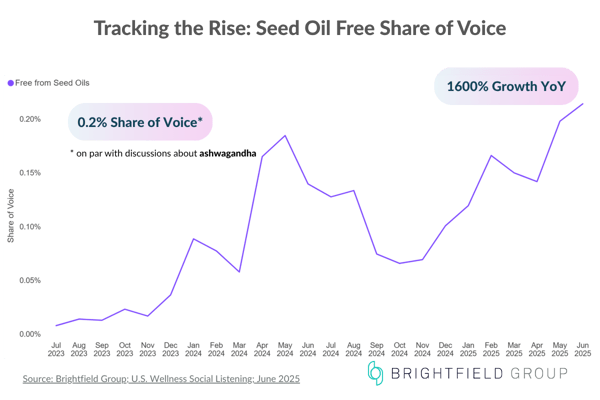

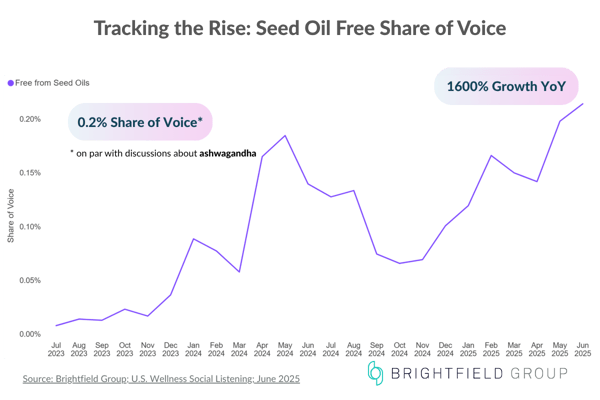

Seed oils are no longer just ingredients—they're identity markers. Social listening data from Brightfield Group shows a 1600% year-over-year growth in conversations about being “free from seed oils,” putting it on par with buzzworthy topics like ashwagandha.

The data reveal a distinct move away from traditional ultra-processed oils like canola, soybean, and corn oil. In their place? Functional fats and “heritage” oils—like beef tallow, avocado oil, and cold-pressed macadamia—are gaining consumer favor. These alternatives tap into a bigger movement: real food, minimal processing, and ingredient transparency.

Key Insights: Who’s Driving the Shift—and Why It Matters

Let’s break down the data.

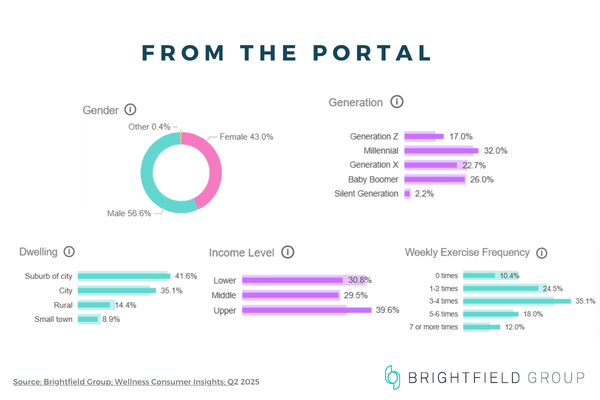

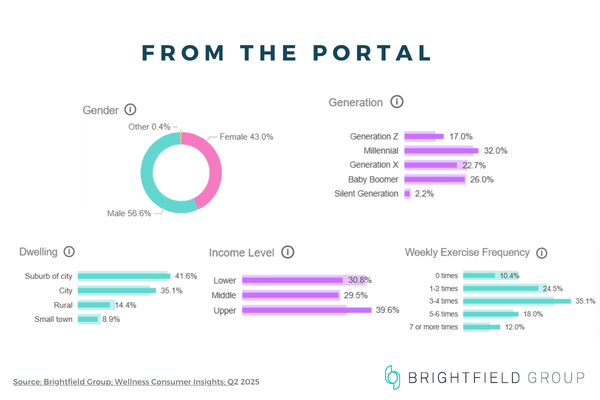

According to Brightfield Group’s Q2 2025 Wellness Consumer Insights:

- 10% of U.S. consumers now consider “no seed oils” an important factor in their purchasing decisions.

- However, only 6% are actively seeking this claim on product labels—up from 5% in Q1. That’s small, but it’s growing fast.

What’s behind this? A psychographic shift.

Consumers opting out of seed oils are more likely to:

- Be Millennial men, followed by Gen X and Boomers.

- Live in suburbs or cities and fall into the upper income bracket.

- Lead active lifestyles, with 43% working out 3–6 times per week.

- Avoid other ingredients too: sugar (64.1%), fat (43.9%), carbs (40.8%), and alcohol (38.1%).

They aren’t just reacting to TikTok trends. These are intentional, informed shoppers seeking brands that align with their holistic health values—hydration, digestion, heart health, and low inflammation.

Real-World Application: Rethinking Oil in Your Innovation Pipeline

Here’s the opportunity: while only a minority of consumers are actively seeking “seed oil free,” they are part of a growing, vocal, and influential group. Think of them like early adopters in the plant-based boom a decade ago.

Brands can act now to stay ahead of the curve.

The “seed oil free” movement may still be niche—but it’s far from fringe. With 1600% YoY growth in online conversation, clear demographic traction, and emotionally driven consumer behavior, it’s a canary in the coal mine for CPG brands.

Innovation is already underway. From lab-grown algae oils to upcycled beef tallow, companies are investing in the next generation of cooking fats—formulations that reflect consumer demand for nutrient integrity, simplicity, and cultural relevance.