The legal cannabis industry has existed for only a couple of decades, and as the industry progresses, so does consumer behavior, engagement, and expectations. The proliferation of legal cannabis has uncovered numerous buyer personas, from Microdosing Mamas to Boomerangs, each with their own habits and preferences. Businesses need to understand their current and prospective consumers in order to effectively market products and grow their company.

Feel free to skip ahead within this guide:

The Importance of Cannabis Consumer Insights? Finding the Right Target Audience

Brands aim to make decisions from their own consumer data - assuming they can pull insights in a clean manner. These insights fuel marketing, product, and overall business decisions. The challenge, however, comes from ensuring the data is truly representative of this rapidly moving market, as well as extracting the proper insights and new trends that put your company in a good position to succeed.

Consumer insights provide a complete view of the types of people that could be your next customers, fueling impactful messaging, compelling products, and greater returns.

Cannabis User Demographics

Demographics are foundational to the start of deep consumer insights. Using demographics to compare the population of consumers is a good place to start, allowing companies to determine the size of a potential group or cohort. Companies can leverage them in order to make decisions on new products, marketing strategies, and content. These can include:

- Age

- Gender

- Income

- Sexuality

- Ethnicity

- Marital Status

- Education

- Parental Status

Cannabis consumers of all different demographics will have varying behaviors across product preference, frequency of use, average spend per product, and other attributes. For example, college students may prefer flower and are less likely to be brand loyal, while married, middle-aged women may prefer low-dose edibles. Changing one or two demographic attributes in your analysis can drastically change what story the data tells you.

Make better marketing decisions with cannabis user demographics

Cannabis Users by Generation

Millennials

Millennials as a cohort are holding steady in their overall share as older groups take up cannabis and expand the consumer base. This generation also represents the leading edge of cannabis use. Younger consumers are considering cannabis as a typical product that fits within their lifestyle.

Gen X

While Generation X has historically lagged behind in cannabis use up until recent years. However, in 2022 they increased their consistency in the use of cannabis, especially in Q3. Use across Gen X age brackets shows that a consistent majority prefer flower as their go-to choice -- specifically, over 65% in Q2 and Q3 of 2022.

Baby Boomers

Baby Boomers as a population have been responsible for huge socio-economic shifts, and their push for medical-use cannabis continues today. Boomers as a whole greatly over-index in citing chronic pain as an ailment compared to the general cannabis-using population. In fact, they are 92% more likely to use cannabis from chronic pain than the average consumer. Their affinity for cannabis products in medical, health and wellness, or adult-use is as robust as any other generation.

Purchase and Usage Behaviors

Many cannabis consumers are used to the dynamics of the illicit market. They often have a dealer they purchase from or get products through their friends. As the industry progresses, more product types enter the fold, and cannabis retail grows, consumer paths to purchase and usage behaviors will become even more complex.

Purchase and usage behaviors can be broken down by asking 4 simple questions: How? Why? What? Where?

How Consumers Use Cannabis

As cannabis has gone national, its prevalence across demographics has too. New markets, new products that offer ease of use, product clarity, and growing public support all have attracted cannabis consumers of all kinds within the past few years.

The ways consumers use cannabis heavily vary depending on demographic attributes, as mentioned previously Consumers will have different preferences on how they choose to ingest the cannabis plant (i.e., edibles, vapes, flower, pre-rolls, etc).

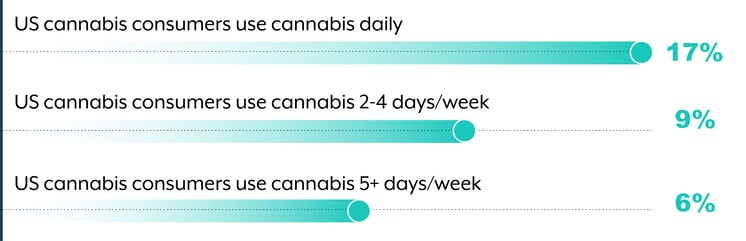

Frequency of use is also important for developing consumer insights as brands look for additional opportunities to incorporate themselves into the daily lives of consumers. Most don’t use cannabis every day, though a significant portion uses 2 to 4 times per week.

Source: Brightfield Group Q3 2022

US Cannabis Consumer Insights

Why Consumers Use Cannabis

Consumers use cannabis for many reasons and occasions. Understanding the ‘why’ helps drive anything from product and brand messaging to distribution strategy and partnerships.

There are occasions, both in and out of the home, where a growing portion of consumers are using cannabis. When it comes to medical conditions, many consumers use cannabis for anxiety or chronic pain. From relaxing at home to outdoor activities and family gatherings, companies are leveraging occasions, experiences, and use cases to drive higher consumer engagement and loyalty with their products.

Where Consumers Buy Cannabis

Where consumers buy cannabis has been a very simple topic in the past– through the illicit market or medical cannabis facilities. As more states and countries move toward adult-use programs, distribution through dispensaries creates an extra layer of complexity.

There is also a growing on-premise movement as legal cannabis establishments emerge. This adds yet another channel for retailers to provide an enjoyable customer experience while brands compete to stand out and get in front of consumers.

Using Cannabis Instead of Alcohol or Tobacco

The Substitution Effect

Millions of consumers across the country have legal access to both alcohol and cannabis. The substitution effect allows us to look at instances where consumers choose one substance over the other.

Cannabis is increasingly being used as a replacement for alcohol consumption. While many cannabis consumers already consume alcoholic beverages, the practice of using both substances together is increasing in popularity. Our data shows consumption of cannabis and alcohol while “at home with friends” was a steady, top occasion throughout all of 2022. “Relaxing at home” was another top occasion for an alcohol and cannabis combination throughout the year, likely due to so much time spent indoors during lockdowns.

On the grander scheme, the legalization of cannabis has also resulted in people shifting their alcohol consumption patterns. A significant portion of cannabis users tend to drink less alcohol after an adult-use program opens in their state. This behavior does not directly align with tobacco consumption, though the majority of cannabis consumers do not even use tobacco.

As more beverage and alcohol companies enter the cannabis space, they will want to identify the substitution behaviors of cannabis consumers to ensure their brand helps curate these occasions and moods.

Get more insights on the recent trends in cannabis occasions

Cannabis Consumer Trend: Cali Sober

Young people are drinking less and using cannabis more, leading to the "Cali Sober" trend that has been around circa 2019. Cannabis consumption can be more universal than alcohol. Additionally, cannabis doesn’t cause hangovers, and is nearly impossible to consume a dangerous amount of it, unlike alcohol. Cannabis consumption is also 0 calories or carbs (unless we’re talking about edibles).

Cannabis Consumers' Personality. What Drives Them To Buy?

With the rapid expansion of the legal cannabis industry, brands are trying to find their way across the ever-expanding ocean of consumer data. Understanding the ‘who’ and ‘what’ are very foundational to robust consumer insights. But what about the ‘why?’

Leveraging data-driven insights on why people spend their money on certain cannabis brands and products is the key to setting up a winning marketing and sales strategy.

Buying decisions are both emotional and logical. Anyone that is a buyer (of any product) is dissatisfied with something, and they are looking for a solution.

People are more likely to respond to product and brand messaging that speaks to their needs on a psychological level. Each person aligns with a set of subjective constructs that can be tapped into in order to help drive purchasing decisions. Here are some of the most common:

- Reward & Incentives – Behavior is dictated by a desire for external rewards

- Power & Authority – Behavior is dictated by the perceived ability to take action and make changes in one’s life or to influence others.

- Belonging & Community – Behavior is dictated by membership, influence, and a shared emotional connection

- Achievement & Accomplishment – Behavior is dictated by external or internal goals

A consumer whose psychological profile is wired around Belonging & Community is less likely to respond positively to messaging aimed at Power & Authority because it is simply not their priority. By tapping into psychological profiles, your cannabis business can deeply relate to consumers by speaking directly to their beliefs and values.

Cannabis Consumer Lifestyles: How Do You Leverage Their Interests?

Cannabis is often a small part of the average consumer’s day. They have jobs, workout routines, hobbies, and social lives. It can be difficult to resonate with consumers when you only know their demographics or usage behaviors. By understanding who they are outside of cannabis, you can begin to get in front of them much more effectively and relate to your cannabis consumers.

From movies and tv shows to music or fitness, it is easy to get overwhelmed with how consumers spend their time. It’s important to categorize your audience if you want to market in a way that resonates. We took to social media listening to gauge the interests of cannabis consumers and this is what we found:

- Fashion & Beauty

- Food & Travel

- Health & Sports

- Home & Community

- Music & Arts

- News & Pop Culture

There are certain categories that rank much higher than the others across various personas. What is most important, however, is understanding the relationships these consumers have with specific people, brands, and organizations on the internet. By understanding brand preference (ie: Target vs. Walmart) or media consumption (ie: True Crime vs. Comedies) across the social landscape, you can drive partnership and content strategies that resonate.

Following the Conversations Around Cannabis

The content that people put out on social media can be a gold mine for brands and consumer insights enthusiasts. Social media gives you the opportunity to understand who and what people are talking about in the context of cannabis. By using social listening as a tool, you can develop robust personas and better reach the audience you intended.

So what do we mean by context? Well, cannabis can be talked about across many different topics. From pain and politics, to fitness and sleep, consumers are discussing cannabis in ways that are increasingly aligning with product segments. Social media can be a very good indicator for consumer and product trends.

Updated 1/3/2023