In an era where energy and vitality are highly valued, consumers are increasingly turning to energy-boosting products to fuel their demanding lifestyles. Using Brightfield Group consumer insights and social listening data, we’ll delve into the world of energy-boosting products, answering key questions and offering valuable insights that can guide your marketing strategies in 2023.

While originally created to help athletes maintain peak physical performance, energy drinks are now marketed as a way of boosting productivity among ordinary people. In today's fast-paced world, people are seeking natural and convenient solutions to sustain their energy levels throughout the day. Energy-boosting products provide a quick pick-me-up, supporting mental focus, physical stamina, and overall well-being.

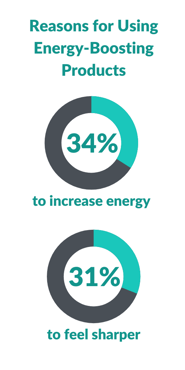

According to Brightfield Group data, 34% of American consumers utilize energy-boosting products to generally increase their energy, while 31% of consumers use them to feel sharper. Other common reasons consumers cite for energy-boosting product usage are combating fatigue post-workout, seeking an alternative to coffee-driven jitters and weight loss. The most popular forms of energy-boosting products are energy drinks, energy shots, and energy-enhanced waters.

Which brands are the most popular?

In the energy-boosting category, several brands have gained significant popularity among consumers. Leading the pack are established names such as Monster, Red Bull, Rockstar, Starbucks, and 5-Hour Energy, known for their wide distribution networks, aggressive marketing, and association with extreme sports and youth culture. Our data shows that consumers are most likely to purchase these beverages at convenience stores and gas stations like 7-Eleven and Circle K (48%), traditional grocers like Kroger and Publix (40%), and big box stores like Target and Walmart (29%).

While the aforementioned brands dominate the energy-boosting market, there is a growing consumer segment seeking alternatives to mainstream options. Emerging brands like Celsius and Zipfizz have also carved a niche by offering unique formulations, healthier ingredients, and appealing branding.

.png?width=600&height=400&name=In-Blog%20Asset%20(16).png)

Additionally, a new class of energy drink brands are offering the best of the wellness world with the added benefit of energy boosting products. Brands such as Vuum, which makes caffeinated drinks with 10g of plant protein, promises to “connect the mind to body with energy and nutrition from green tea, guarana, theanine, and pea protein”. GORGIE, another wellness-infused energy drink brand, makes natural, sparkling energy drinks with green tea caffeine, vitamins, and biotin. They brand themselves as an energy drink “for Monday morning motivation, pre-workout boosts, 3PM pick me ups, and Saturday night dance parties”. The wellness-infused energy drink trend will likely continue in the coming years. GORGIE and Vuum are just two examples of brands that use natural ingredients to create beverages that promote healthy living while also providing energy.

Consumers have come to expect more from their energy drinks than simply a jolt of caffeine.They also want them to be full of vitamins and minerals that will help them feel good about themselves. And with the rise in popularity of wellness products and brands, it’s no surprise that many energy drink brands are making changes to their formulas to better suit this trend.

Are there gender/generational differences in reasons for purchasing?

When it comes to energy-boosting products, there are notable gender and generational differences in consumer preferences. Millennials and Gen X make up the majority of consumers of the more traditional energy drink brands, accounting for 77% of Monster drinkers. Emerging energy-boosting beverages are most popular amongst Gen Z, who may prefer natural or organic alternatives. For example, Gen Z makes up 31% of Zipfizz consumers. Male consumers are most likely to purchase energy-boosting beverages to feel sharper. Female consumers, on the other hand, show a higher inclination towards products that promote mental clarity.

.png?width=600&height=400&name=In-Blog%20Asset%20(17).png)

Do consumers with specific diets prefer certain brands over others?

Consumers with specific dietary preferences often gravitate towards brands that align with their needs. For instance, individuals following a low-sugar diet may prefer brands like Monster or Redbull, who offer low-carb and sugar-free options. Consumers following ketogenic diets may choose these popular brands for the same reason. Plant-based consumers and vegans are more likely to opt for newer, alternative brands like Nuun and TeaZa for their cleaner ingredients lists. By catering to specific dietary requirements, brands can effectively capture niche markets and establish loyal customer bases.

What do consumers wish that these brands did differently?

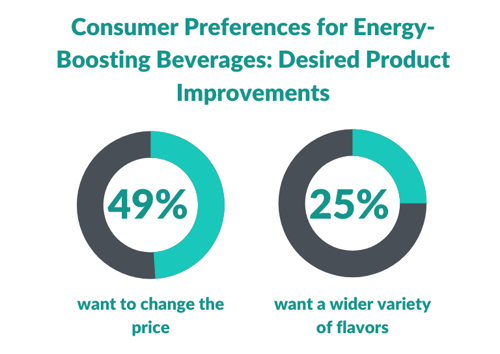

While American consumers are generally satisfied with the state of the energy-boosting beverage market, there is room for improvement in some areas. Brightfield group data shows that 49% of consumers wish to change the price of energy-boosting beverages, while 25% of consumers wish that there were a wider variety of flavors in the market. Digging deeper into the data, 16% of women wish that brands would address the jittery feeling that sometimes comes about after consuming an energy-boosting beverage. Meanwhile, Gen Z wishes to combat the post-energy drink crash, with 24.8% of them citing it as an issue.

As the demand for energy-boosting products continues to rise, marketers in the functional beverage and snack industries must pay close attention to consumer preferences, shifting trends, and evolving demographics. Understanding why consumers use these products, the popularity of different brands, demographic nuances, and specific dietary preferences can inform targeted marketing strategies that resonate with the desired audience. By leveraging these insights, your brand can position itself at the forefront of the energy-boosting products.

Published: 7/6/2023